Client

Industry

Fintech

year

2022 - 2024

Scope of work

share

About

The Challenge

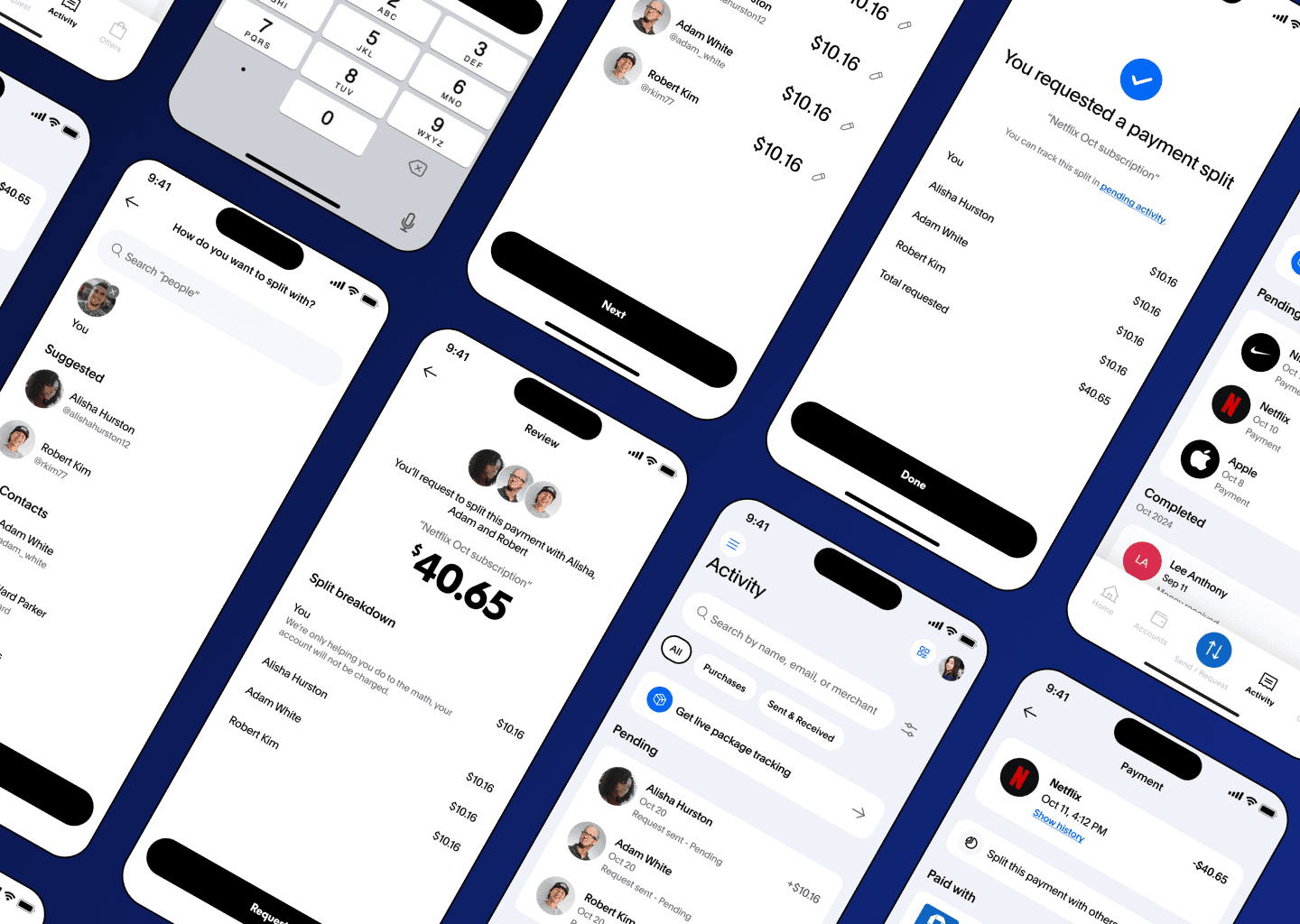

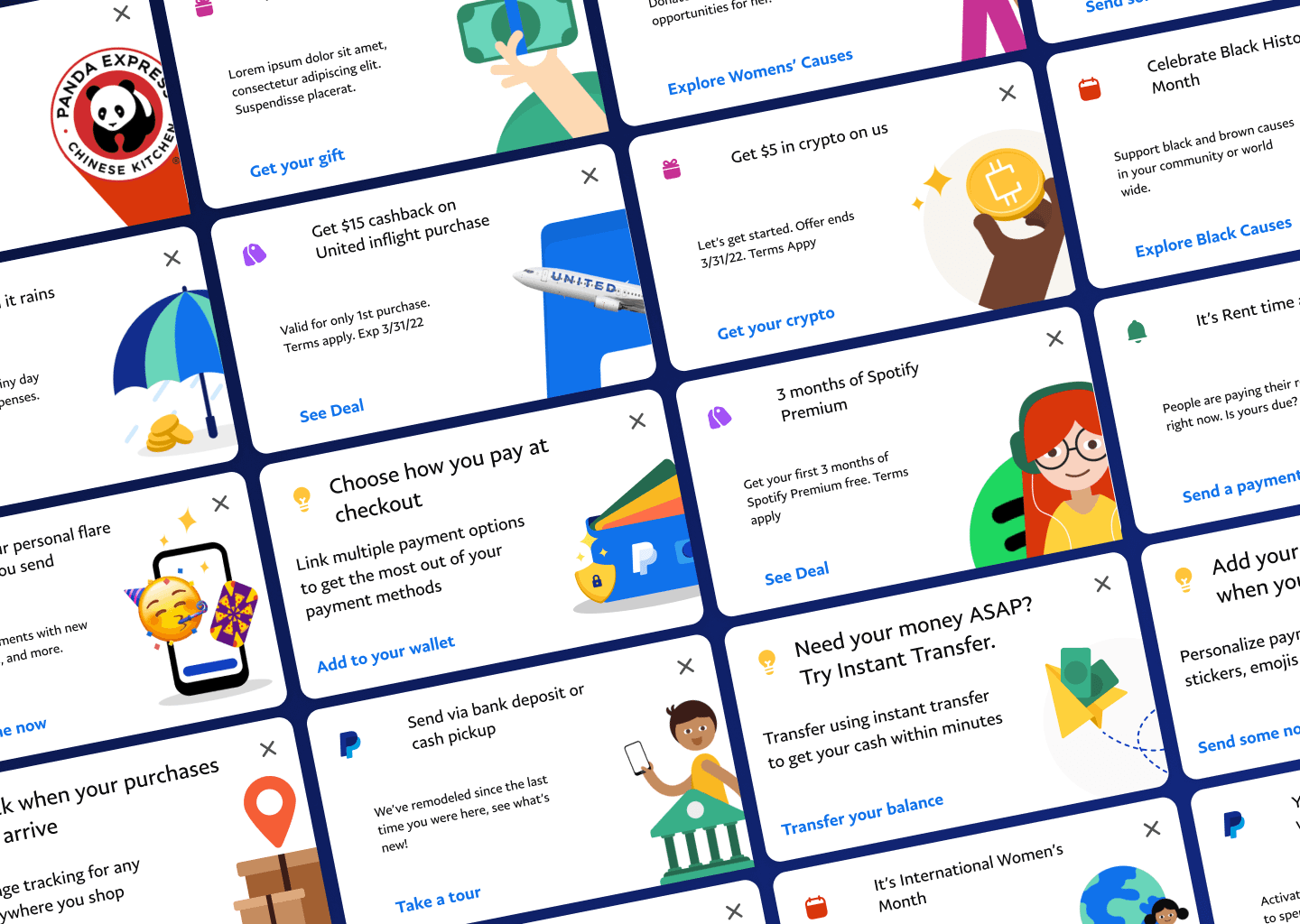

• 15 moderated user interviews with drop-off users revealed that people wanted to experience PayPal's value before committing to full verification

• Heatmap analysis showed significant hesitation at identity verification steps, with average dwell time of 47 seconds before abandonment

• Support ticket analysis confirmed that 34% of new user inquiries stemmed from confusion during account setup

• Mobile analytics revealed that 68% of signups started on mobile, but completion rate was only 31% compared to 54% on desktop

Our Approach

Crypto Integration

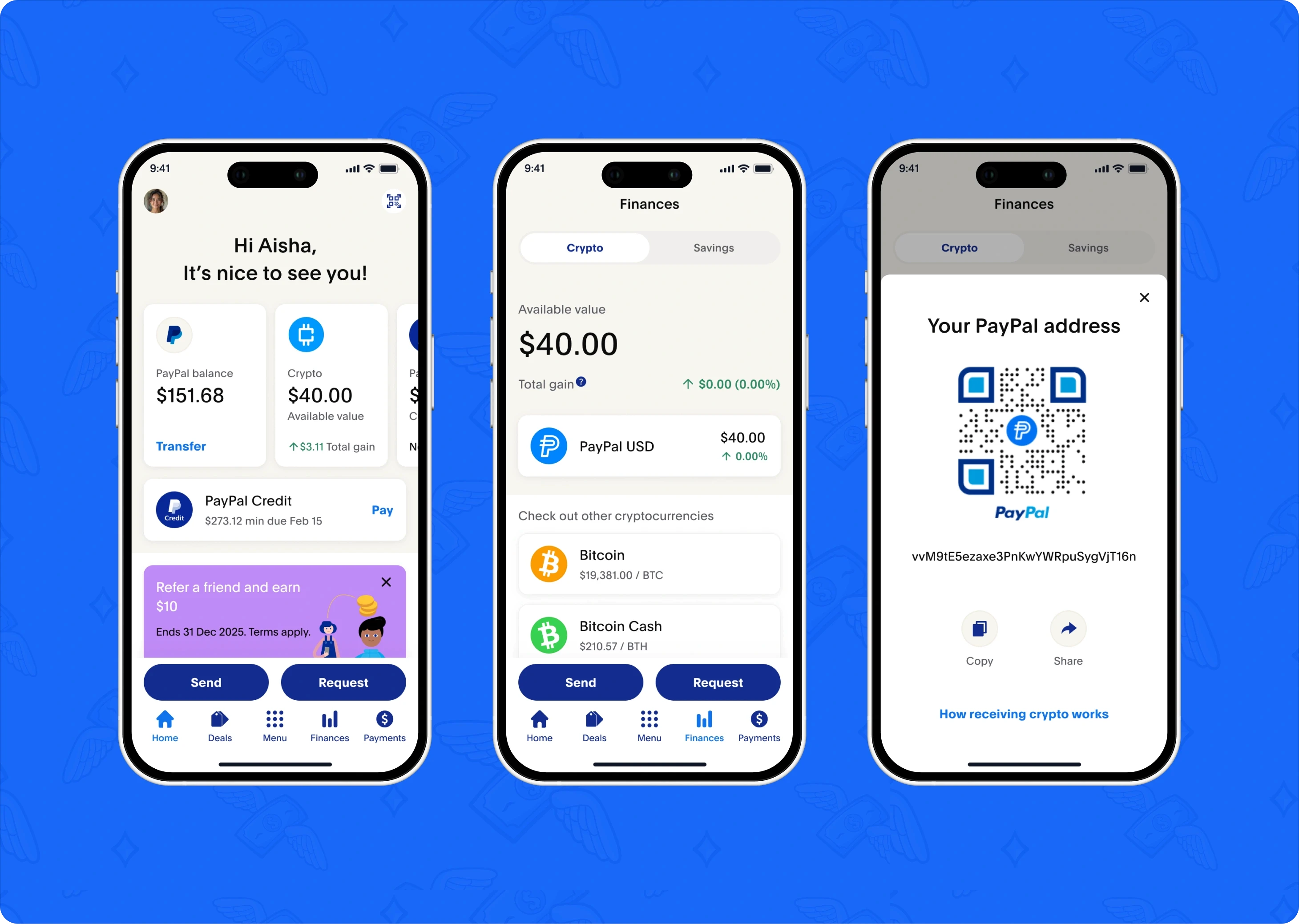

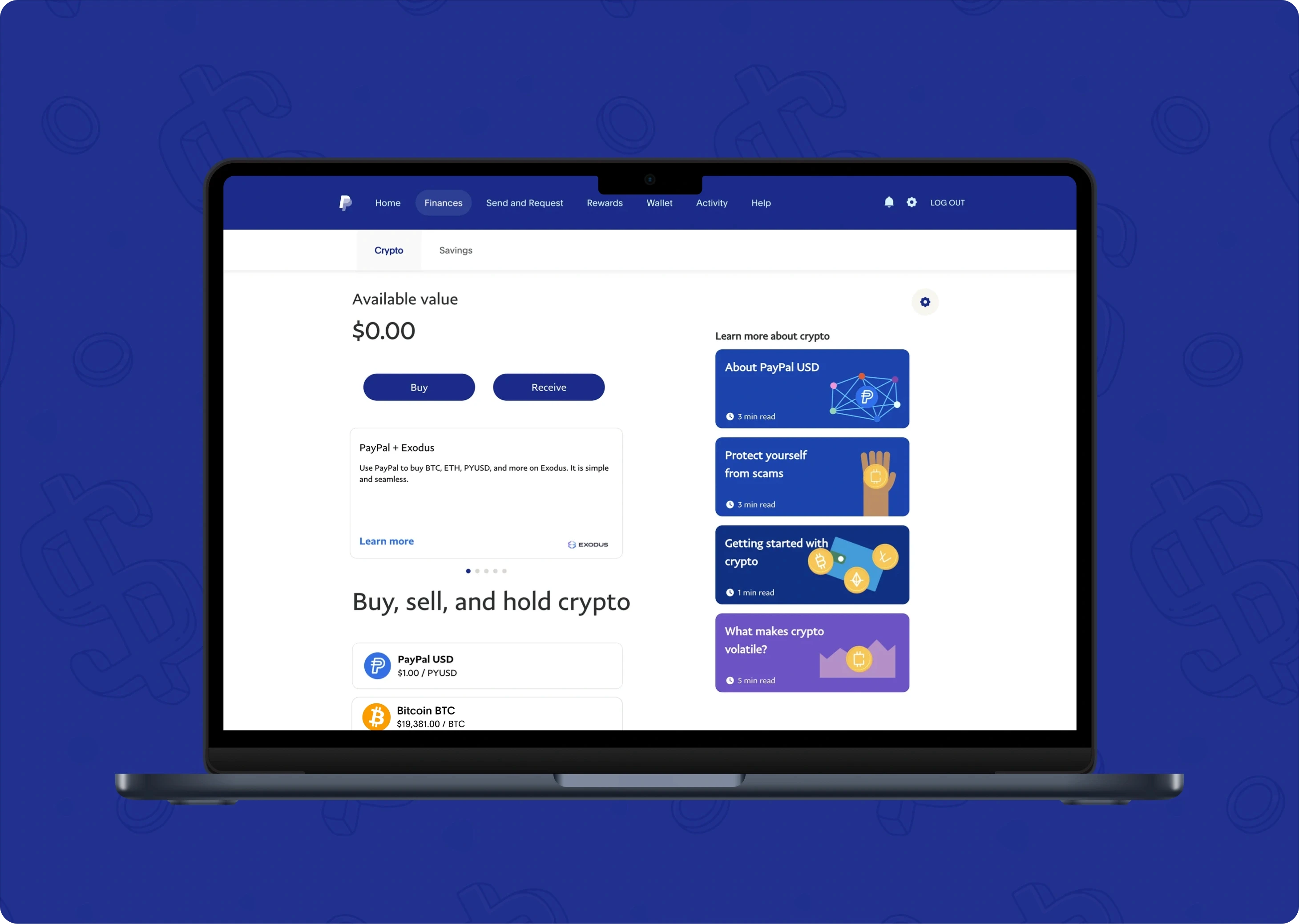

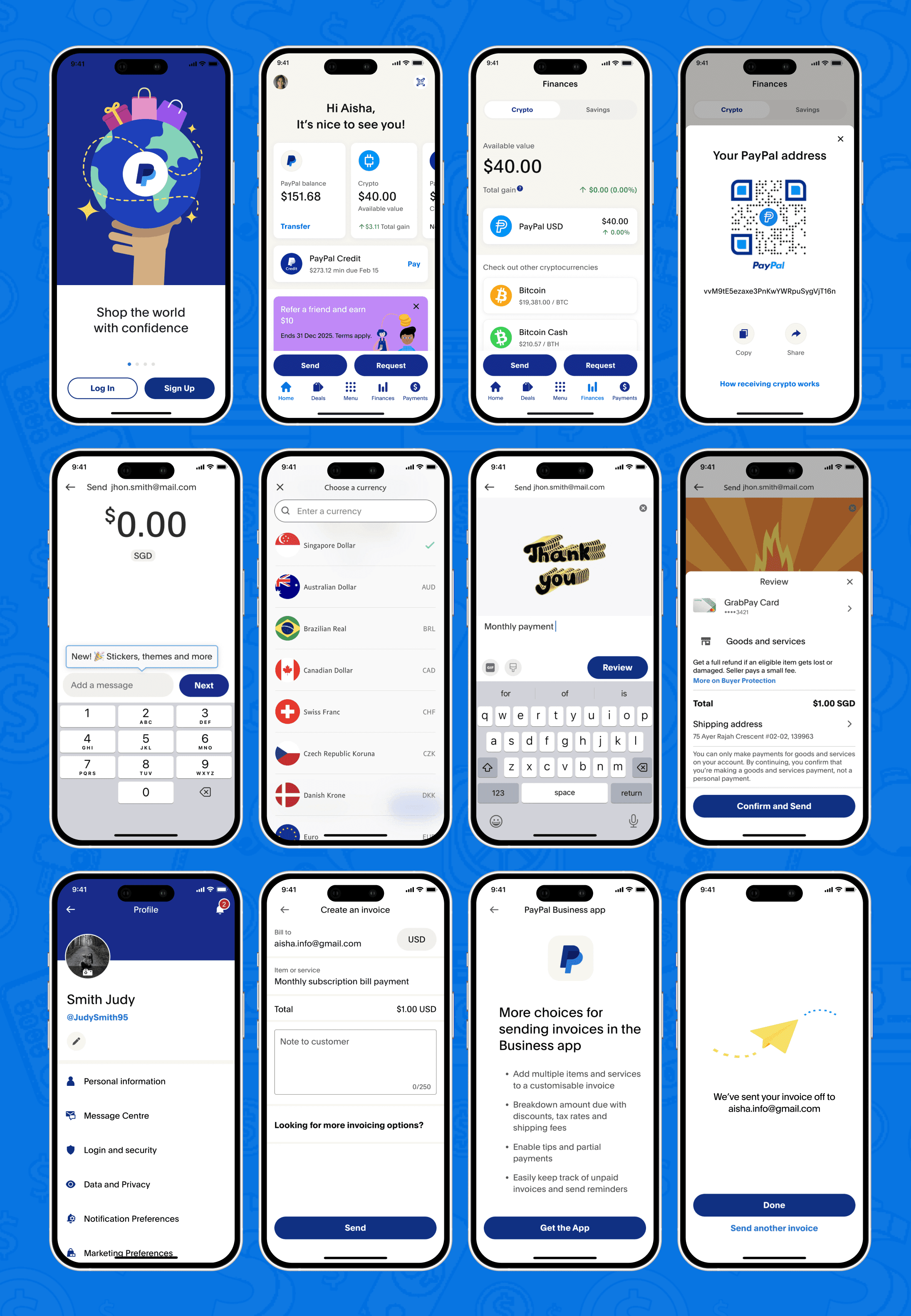

When PayPal entered the cryptocurrency market in 2020, they faced a significant UX challenge. Our research revealed that mainstream users were curious about crypto but felt overwhelmed by technical complexity. Terms like "blockchain," "wallet addresses," and "gas fees" created an immediate sense of being out of one's depth. Users who had tried crypto elsewhere reported anxiety about making costly mistakes.

Design approach

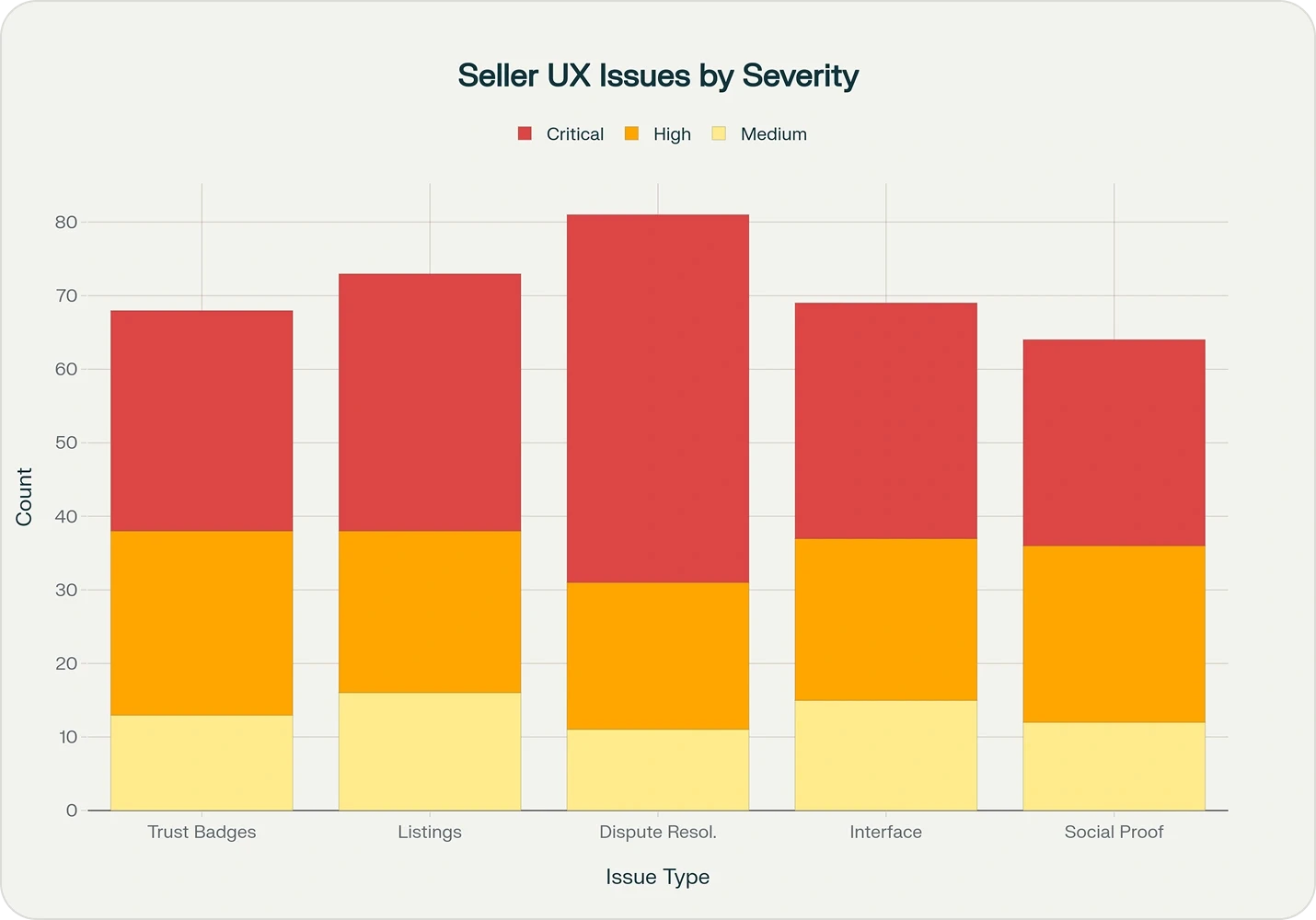

Profile Optimization

PayPal serves over thirty million merchant accounts ranging from solo entrepreneurs to large e-commerce operations. Our research with forty-seven merchants revealed that as PayPal's capabilities had grown, the merchant dashboard had become a maze of features without clear hierarchy. Small business owners felt overwhelmed by data they didn't understand. Growing businesses struggled to access critical functions quickly. Everyone spent too much time searching and not enough time understanding their business performance.

● Morning check-ins

Focused on overnight orders and customer messages

● Midday management

dealt with customer inquiries and fulfillment

● Evening reviews

analyzed performance and planned for growth

Crypto Integration

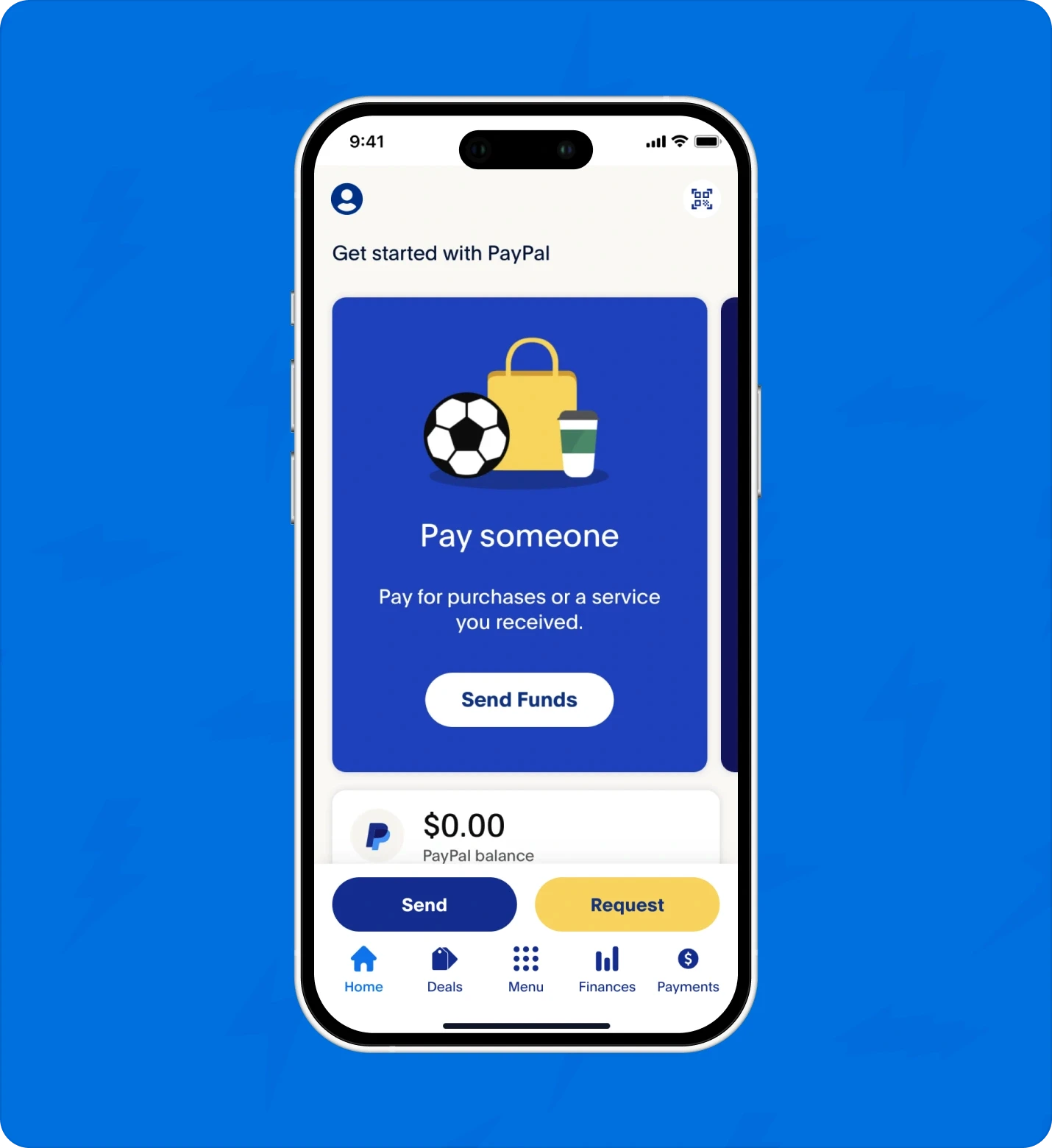

Crypto introduced fear, jargon, and complexity. Users felt overwhelmed by terms like wallet addresses and gas fees. We reframed crypto through PayPal’s familiar mental models:

● Buying Crypto Worked like adding money to a PayPal balance

● Price charts were simplified with clean % changes

● A “Learn” hub delivered guidance at the moment of action

● Flows used biometric confirmation, with no wallet addresses or technical barriers

The experience made crypto feel accessible, safe, and aligned with PayPal’s trusted ecosystem.

ai integration

PayPal’s UX design improvements fueled by GenAI directly responded to user frustrations around technical clarity, navigation, and workflow support. The core design changes focused on: Centralizing resources and making documentation easily discoverable - Embedding GenAI-powered agentic chatbots and contextual prompts for instant answers and tailored guidance as developers work - Integrating dynamic video tutorials and best practices precisely where users need them. These UX enhancements minimize friction, reduce confusion, and enable developers to complete payment integrations more efficiently, resulting in higher success rates and lower support burdens. The GenAI-driven UX delivers more adaptive, intelligent, and personalized experiences throughout PayPal’s technical environment, ensuring both developer and merchant needs are met seamlessly.

Brand refresh

In 2024, Pentagram rebranded PayPal with a new logo and typeface, representing the company's evolution and modern positioning. Our challenge was implementing this new visual language across hundreds of product screens and marketing touchpoints while ensuring consistency and maintaining or enhancing usability.

We worked closely with Pentagram and PayPal's product teams to translate brand guidelines into practical design systems. This wasn't simply swapping logos and fonts. We needed to ensure the new typography hierarchy improved readability, that color updates maintained accessibility standards, and that the refreshed visual language felt cohesive across vastly different experiences—from the consumer app to merchant tools to crypto interfaces.

We created comprehensive component libraries that encoded the new brand while preserving functional patterns users knew. Every button, form field, and modal received careful attention to ensure the refresh enhanced rather than disrupted familiar workflows. We conducted testing to verify that the new visual language improved rather than hindered task completion, particularly for accessibility considerations around contrast ratios and text legibility.

The rollout happened in carefully orchestrated phases, allowing us to gather feedback and make refinements. We prioritized high-traffic touchpoints first, ensuring the most visible parts of PayPal's ecosystem reflected the new brand identity while giving us data to optimize the approach for subsequent releases.

Lorem

Conclusion

Across two years, we helped PayPal rethink its consumer, merchant, developer, and brand experiences. From onboarding to crypto, merchant workflows to brand refresh, our work reduced friction, increased confidence, and improved long-term user engagement. As digital finance continues to evolve, these experience principles position PayPal to serve the next generation of global users with clarity, consistency, and trust.