Last Update:

Feb 17, 2026

Share

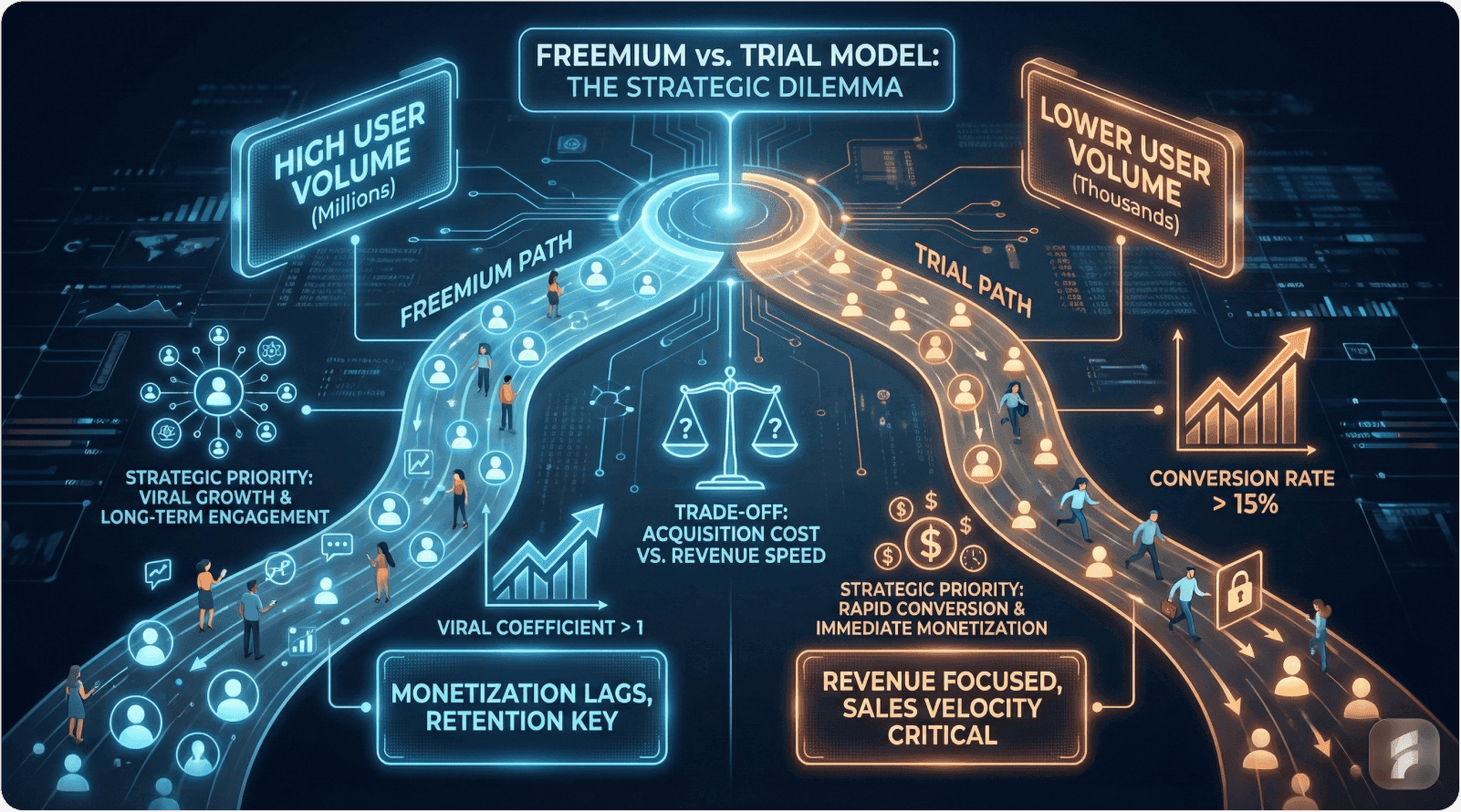

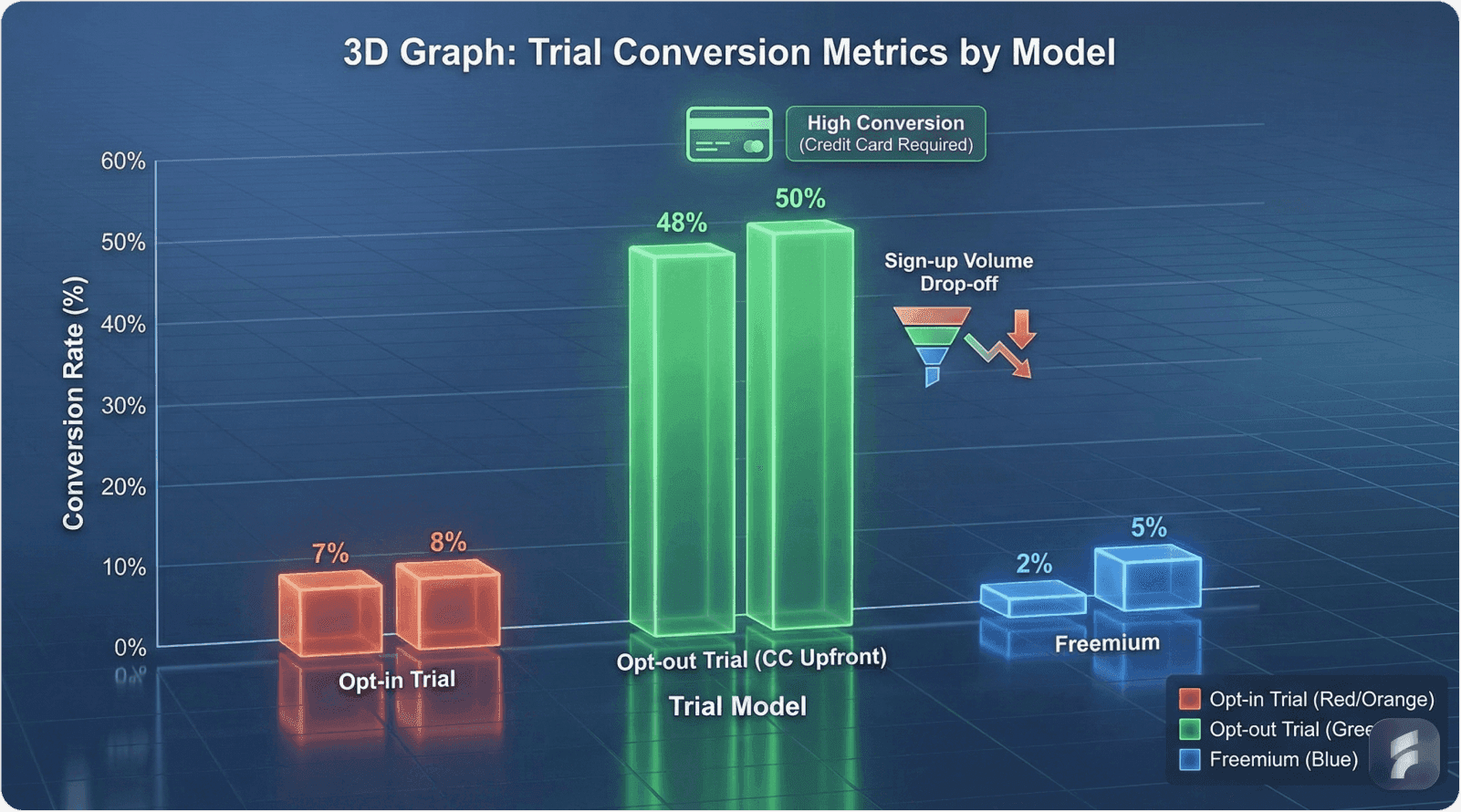

Free trial conversion rates average 17-18% (opt-in) and 48-50% (opt-out), while freemium converts at 2-5%, requiring different optimization strategies for each model

Opt-out trials with credit cards convert 3x higher than opt-in trials, but reduce signup volume by 60-70% due to payment friction

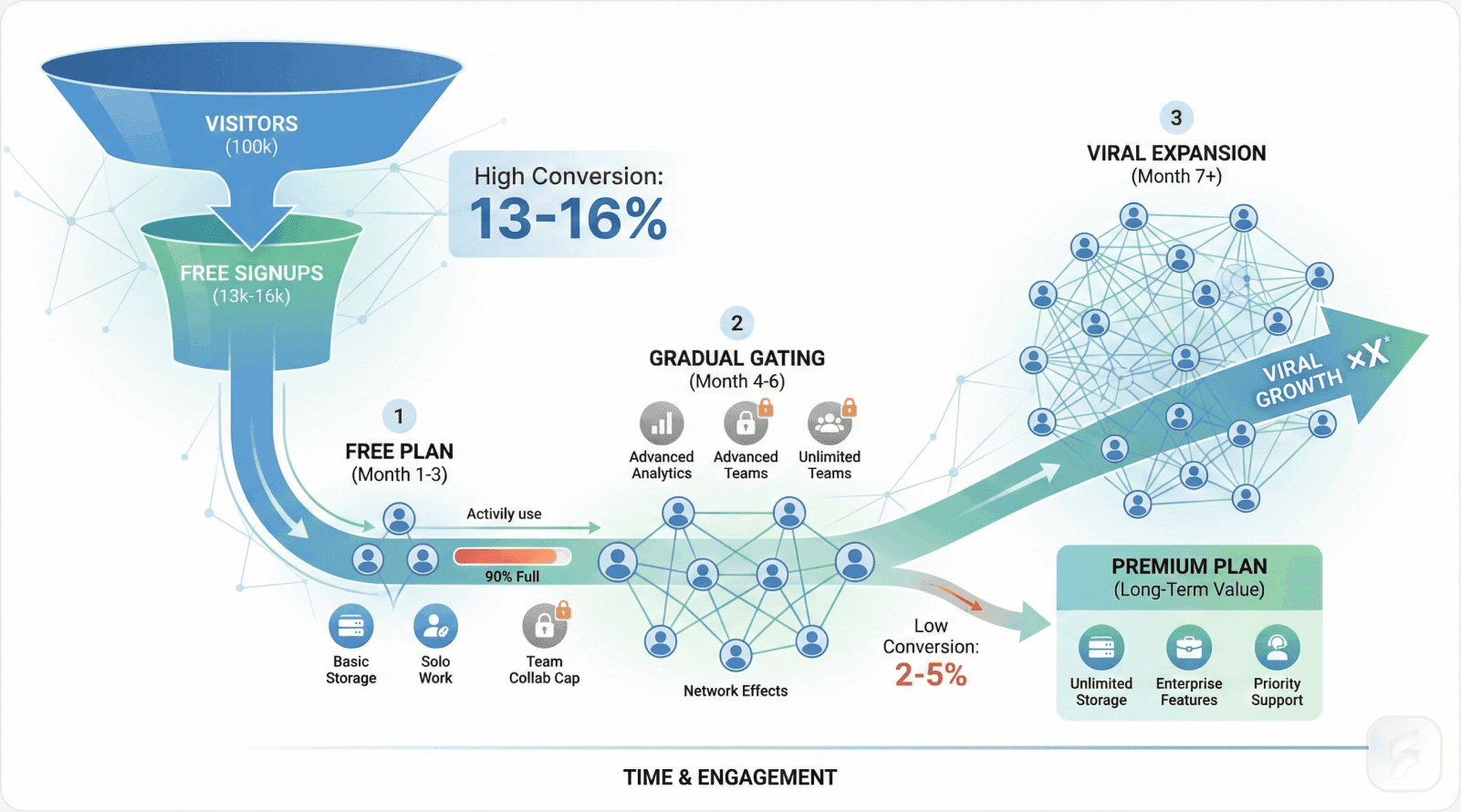

Freemium excels for viral products with simple onboarding, achieving 13-16% visitor-to-signup rates compared to 7-8% for trials

Products with ACV above $50 and complex workflows perform better with trials, while sub-$20 viral tools succeed with freemium

Hybrid models combining freemium acquisition with premium feature trials represent the fastest-growing adoption strategy in 2026, used by 65% of PLG-focused SaaS

Time-to-paid conversion differs dramatically: trials average 12-18 days while freemium requires 90-180 days to monetization

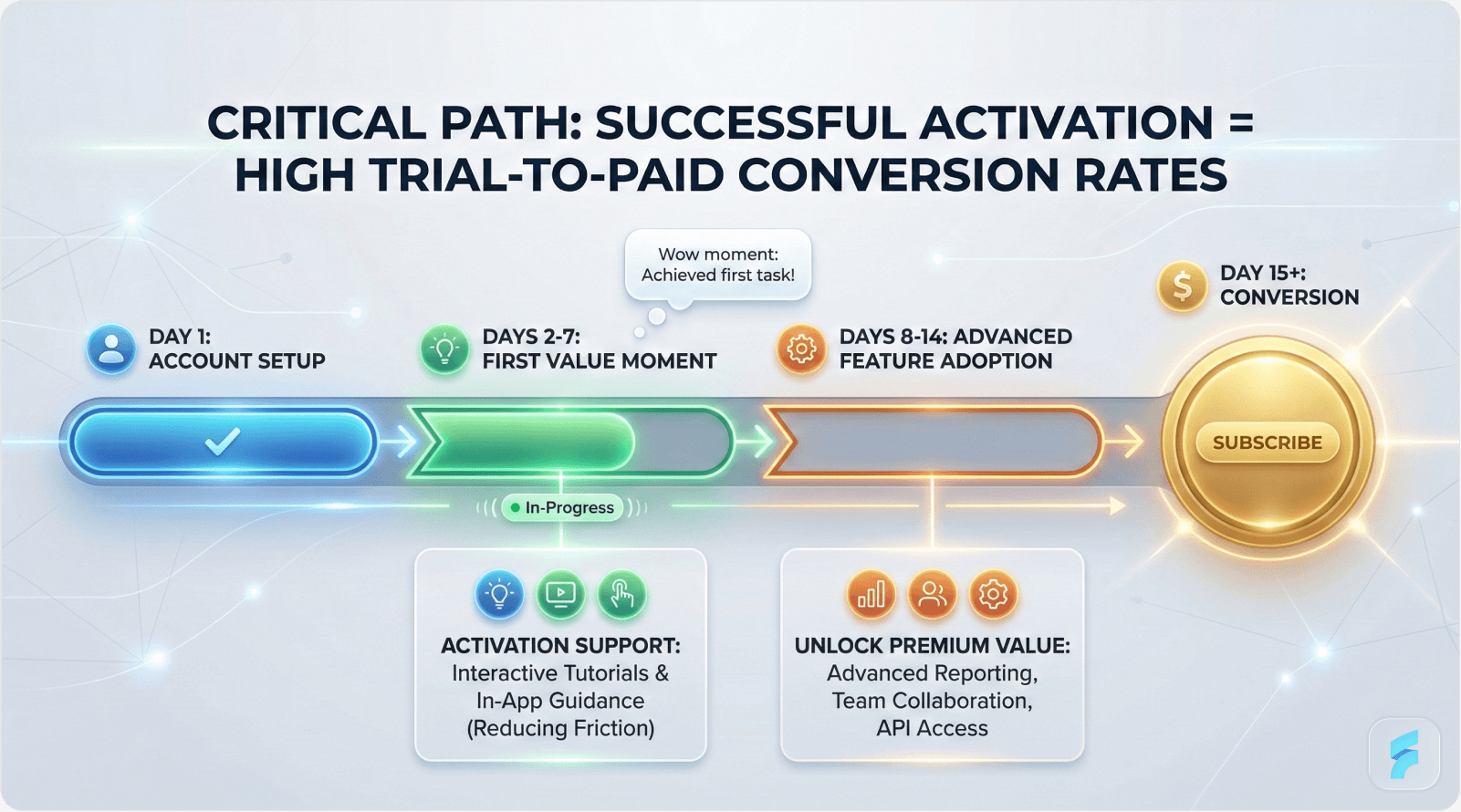

Successful trial optimization requires milestone-based onboarding, achieving 25%+ activation rates in the first 72 hours

Freemium sustainability demands 4%+ free-to-paid conversion or progressive usage gates to prevent support cost overload

The optimal trial length for B2B SaaS is 14 days, balancing sufficient evaluation time with conversion urgency

Strategic model selection should prioritize product complexity, target market characteristics, and viral coefficient over competitor imitation

Choosing between free trials and freemium models represents one of the most consequential decisions in SaaS product strategy. This choice fundamentally shapes customer acquisition costs, conversion economics, and long-term growth trajectories.

The stakes are substantial. A misaligned conversion model can increase CAC by 200-300% while simultaneously degrading user experience and limiting scalability. Conversely, the optimal model unlocks sustainable unit economics and accelerates product-led growth.

This comprehensive guide examines both models through empirical data, real-world case studies, and proven optimization frameworks. By understanding the mechanics, benchmarks, and strategic implications of each approach, founders and product leaders can make informed decisions that align conversion architecture with product characteristics and market dynamics.

Understanding Conversion Model Fundamentals

The Trial Model Architecture

Free trials grant complete product access for a defined period—typically 7 to 30 days—after which access terminates unless users convert to paid subscriptions. This model prioritizes depth over breadth, enabling prospects to experience full value before commitment.

Core Mechanism: Time-Constrained Value Demonstration

Trials operate on a psychological principle of loss aversion. Users gain unrestricted access to features, workflows, and integrations, building dependency and perceived value. The approaching deadline creates urgency that accelerates purchase decisions.

Definition Block: Opt-In vs. Opt-Out Trials

Opt-in trials require only email signup, with payment collection at conversion. Opt-out trials capture credit card details upfront, automatically converting to paid unless canceled. This distinction fundamentally alters both conversion economics and user psychology.

Optimal Use Cases for Trial Models

Complex B2B Software

Products requiring significant configuration, integration, or workflow customization benefit from trial periods. CRM platforms, analytics tools, and automation software need time for users to implement solutions and demonstrate ROI.

According to research from ChartMogul, B2B SaaS products with 3+ integration dependencies convert 34% higher with trials compared to freemium alternatives. The extended evaluation period allows technical teams to validate capabilities against specific requirements.

High-Value Enterprise Solutions

Enterprise software with annual contract values exceeding $5,000 requires comprehensive evaluation. Trials enable multiple stakeholder involvement, proof-of-concept validation, and risk mitigation before substantial financial commitment.

Statistical Evidence: Products with ACVs above $50 monthly achieve 40-60% higher conversion rates through trials compared to freemium models, according to ProfitWell's 2025 SaaS Metrics Report.

Products Requiring Behavioral Change

Tools that replace existing workflows or introduce new methodologies benefit from immersive trial experiences. Users need time to overcome activation energy and experience transformative value before commitment.

Expert Perspective: David Skok, venture capitalist at Matrix Partners, explains: "For products that require users to change behavior or replace established tools, trials provide the runway necessary to demonstrate superior value. Freemium often fails here because users never fully commit to the transition."

The Freemium Model Architecture

Freemium provides permanent access to core functionality with strategic feature limitations designed to encourage eventual upgrade. Users can extract genuine value indefinitely while encountering gates that make paid tiers increasingly attractive.

Core Mechanism: Progressive Value Realization

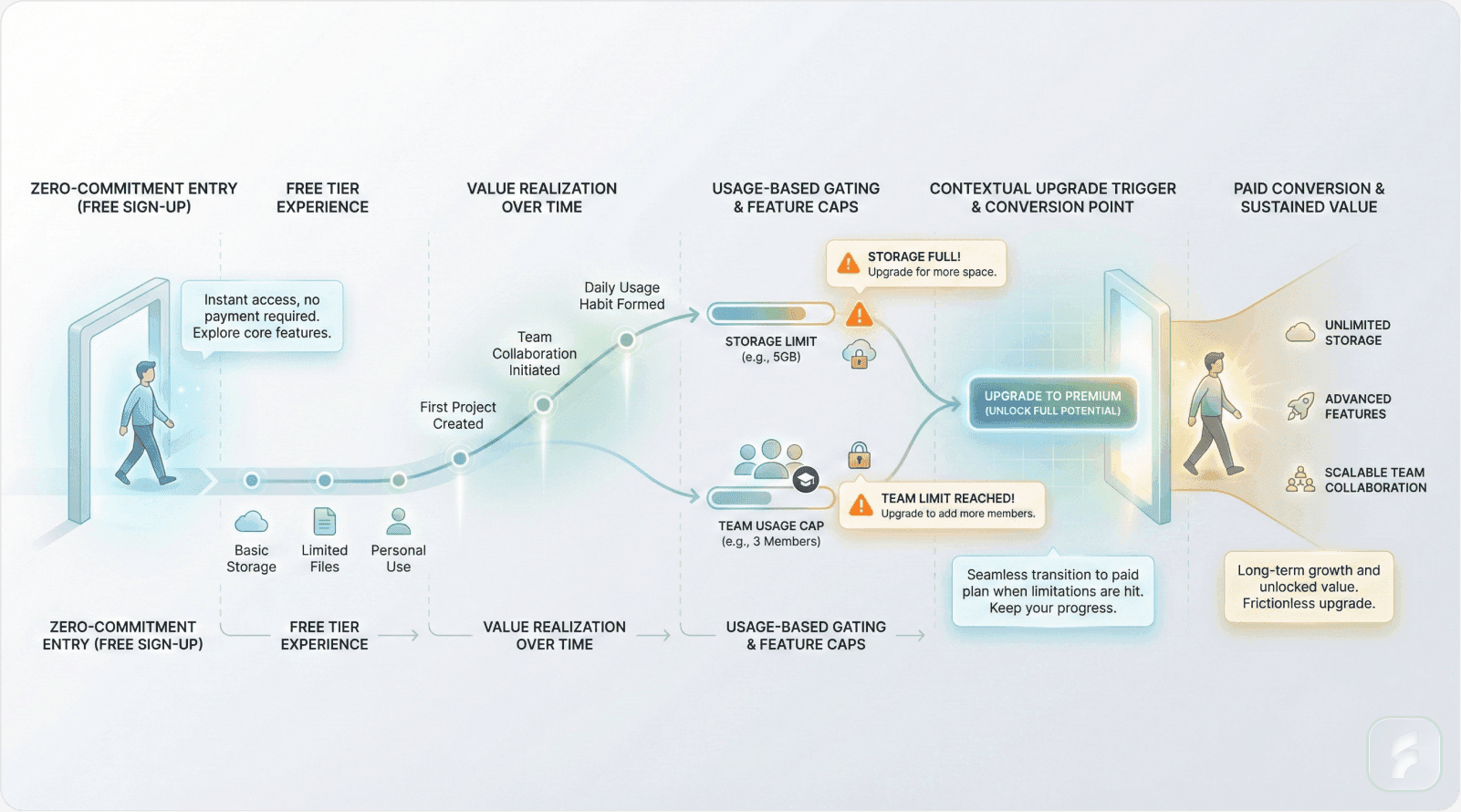

Freemium operates on gradual commitment escalation. Users adopt the product without friction, develop usage habits, and eventually encounter limitations that justify paid upgrades. This approach prioritizes volume and viral distribution over immediate monetization.

Technical Term: Usage-Based Gating

Usage-based gating restricts access based on consumption metrics—storage capacity, monthly active users, API calls, or feature utilization—rather than time constraints. This creates natural upgrade triggers aligned with customer value realization.

Optimal Use Cases for Freemium Models

Viral Network-Effect Products

Communication tools, collaboration platforms, and social products benefit from freemium's zero-friction adoption. Each additional user increases network value, creating compounding growth dynamics.

Slack's freemium model exemplifies this strategy. By 2025, 80% of paid workspaces originated as free teams, with network effects driving organic expansion and eventual conversion through message history limitations and integration caps.

Simple, Immediate-Value Tools

Products delivering instant gratification without configuration complexity succeed with freemium. Note-taking applications, basic design tools, and productivity utilities provide immediate value that hooks users before presenting upgrade paths.

Statistical Impact: Tools with sub-5-minute time-to-value achieve 13-16% visitor-to-signup conversion with freemium, compared to 7-8% for trials, according to FirstPageSage benchmarking data.

Consumer and SMB-Focused Products

Low average contract value products targeting individual consumers or small businesses benefit from freemium's accessibility. The zero-commitment entry point reduces psychological barriers for price-sensitive segments.

For more insights on product-led growth strategies, explore our comprehensive resources.

Micro-Summary: Trial models excel for complex, high-value B2B products requiring comprehensive evaluation, while freemium succeeds with simple, viral tools targeting volume adoption. The optimal choice aligns with product complexity, value delivery speed, and target market characteristics.

Conversion Mechanics and Performance Benchmarks

Trial Conversion Economics

Understanding trial conversion requires analyzing the complete funnel from visitor awareness through paid subscription. Each stage presents optimization opportunities and failure points.

Opt-In Trial Performance

Visitor-to-Trial Conversion: 7-8%

Opt-in trials requiring only email addresses convert approximately 7-8% of qualified website visitors. This relatively low conversion reflects deliberate consideration rather than impulsive signup.

Trial-to-Paid Conversion: 17-18%

Among trial users, 17-18% convert to paid subscriptions. This represents users who successfully activated, experienced value, and overcame payment friction before deadline expiration.

Formula Block: Trial Conversion Rate Calculation

Activation Challenges

Research from Userpilot indicates that 60-70% of trial users never complete critical activation milestones. They create accounts but fail to experience core value propositions, leading to inevitable churn at trial expiration.

Expert Analysis: Lincoln Murphy, customer success consultant, notes: "Most trial failures occur not at conversion but at activation. Users sign up with intent but lack guidance to experience transformational value quickly enough to justify payment."

Opt-Out Trial Performance

Visitor-to-Trial Conversion: 2-3%

Requiring credit card information upfront dramatically reduces signup rates to 2-3% of visitors. This reflects increased commitment threshold and payment method friction.

Trial-to-Paid Conversion: 48-50%

However, users who overcome payment friction convert at 48-50%—nearly triple opt-in rates. The credit card requirement filters for higher-intent prospects while automatic conversion eliminates final decision friction.

Statistical Evidence: According to Totango's SaaS Metrics Report, opt-out trials generate 40% higher customer lifetime value despite lower signup volumes, as they attract more qualified, committed users.

Conversion Timeline Analysis

Time to First Value: 24-48 hours critical

Trial success correlates strongly with rapid value realization. Users experiencing meaningful outcomes within 48 hours convert at 3x the rate of those with delayed activation.

Peak Conversion Window: Days 3-5

The majority of trial conversions occur between days 3-5, after users overcome initial learning curves but before deadline urgency peaks. This represents the optimal intervention window for conversion optimization.

Time-to-Paid Average: 12-18 days

Successful trial users convert to paid subscriptions within 12-18 days on average, with 14-day trials showing optimal balance between evaluation sufficiency and conversion momentum.

Freemium Conversion Economics

Freemium economics differ fundamentally from trials, requiring long-tail patience and volume-dependent strategies.

Freemium Performance Metrics

Visitor-to-Signup Conversion: 13-16%

Freemium's zero-commitment entry achieves 13-16% visitor conversion—nearly double trial rates. This reflects reduced psychological barriers and broader appeal across customer segments.

Free-to-Paid Conversion: 2-5%

However, only 2-5% of free users eventually upgrade to paid tiers. This low conversion necessitates massive user acquisition to achieve meaningful revenue.

Statistical Reality: Freemium products require 20-50x the user volume of trial products to generate equivalent revenue, according to CrazyEgg's conversion analysis.

Expert Perspective: Hiten Shah, founder of Nira, explains: "Freemium is a volume game. You need thousands of active free users to generate hundreds of paid customers. The model only works if your unit economics support this ratio or if free users provide network value to paid customers."

Conversion Timeline Characteristics

Time to First Upgrade: 90-180 days

Freemium users convert to paid tiers after 90-180 days on average—6-10x longer than trial users. This extended timeline reflects gradual value accumulation and progressive limitation encounters.

Progressive Gating Strategy

Successful freemium products implement tiered limitation encounters. Initial usage fits comfortably within free constraints, creating positive experiences. Over time, growing needs systematically hit gates—storage limits, collaboration caps, advanced features—creating natural upgrade triggers.

Case Study: Canva's Freemium Evolution

Canva provides robust free design capabilities attracting 60+ million monthly active users. Their freemium model converts 4-6% to paid subscriptions through strategic gates:

Template limitations requiring Pro access for premium designs

Brand kit features essential for business consistency

Team collaboration features gated for multi-user scenarios

Storage constraints encouraging upgrade for content creators

Visual limitation prompts—"Upgrade to access this template"—generate 25% higher conversion compared to generic upgrade messaging, demonstrating contextual gate effectiveness.

Micro-Summary: Trial economics favor quality over quantity with 17-18% conversion rates but lower signup volumes, while freemium prioritizes volume with 13-16% signups converting at only 2-5%. Trials reach monetization in 12-18 days versus freemium's 90-180 days, requiring fundamentally different growth strategies.

Strategic Advantages and Limitations

Trial Model Deep Analysis

Competitive Advantages

Premium Value Perception

Time-limited full access creates perception of premium value. Users recognize they're experiencing the complete product, enhancing perceived worth and justifying price points.

According to behavioral economics research from Dan Ariely at MIT, products with trial periods command 15-25% higher willingness-to-pay compared to freemium alternatives offering similar functionality.

Accelerated Revenue Recognition

Trials compress evaluation and conversion cycles, enabling faster revenue realization. This improves cash flow dynamics and reduces customer acquisition payback periods.

Statistical Impact: Trial-based SaaS companies achieve median payback periods of 5-7 months compared to 12-18 months for freemium products, according to SaaS Capital benchmarking.

Predictable Conversion Forecasting

Trial conversion funnels provide predictable, data-rich forecasting capabilities. Cohort analysis enables accurate revenue projection based on signup volumes and historical conversion rates.

Data-Rich Optimization

Trial periods generate comprehensive usage data enabling sophisticated personalization. Full feature access reveals genuine preferences, pain points, and value drivers for targeted interventions.

Strategic Limitations

High Abandonment Risk

Without proper activation support, 75-85% of trial users abandon before conversion. The time constraint creates urgency but also generates stress that can trigger premature abandonment.

Activation Friction Challenge

Complex products requiring extensive configuration or learning create activation barriers. Users who fail to experience value within the first 72 hours rarely convert.

Solution Framework: Milestone-Based Onboarding

Milestone | Timing | Purpose | Impact on Conversion |

|---|---|---|---|

Account setup | Day 1 | Reduce initial friction | 40% reduction in immediate abandonment |

First value moment | Hours 2-4 | Demonstrate core capability | 3x increase in Day 7 retention |

Integration/customization | Day 2-3 | Embed in workflows | 2.5x lift in trial-to-paid conversion |

Advanced feature adoption | Day 5-7 | Reveal premium value | 35% increase in willingness-to-pay |

Team/stakeholder expansion | Day 7-10 | Create organizational dependency | 60% reduction in cancellation risk |

Payment Method Friction

Opt-in trials face conversion drop-off at payment collection, with 30-40% of users who intend to subscribe abandoning during checkout due to payment friction, expired cards, or decision procrastination.

Expert Analysis: Elena Verna, former growth advisor at HubSpot, notes: "The payment moment in opt-in trials represents the highest friction point. Users have already decided on value but must overcome payment logistics. Streamlined one-click checkout and saved payment methods reduce abandonment by 25-35%."

Freemium Model Deep Analysis

Competitive Advantages

Viral Distribution Mechanisms

Freemium's zero-friction entry enables rapid viral expansion. Referral programs, collaboration invitations, and content sharing create exponential growth loops.

Case Study: Dropbox Referral Economics

Dropbox's freemium model included strategic referral incentives—500MB additional storage per successful referral, up to 16GB. This program drove 35% of signups and contributed to 500+ million user acquisition by 2025.

The referral mechanism created sustainable viral coefficient above 1.0, meaning each user acquired more than one additional user on average, enabling exponential growth without proportional marketing spend.

Network Effect Compounding

Products with network effects benefit disproportionately from freemium volume. Each additional user increases value for existing users, creating defensible competitive moats.

Slack exemplifies network effect monetization. Free teams create organizational familiarity, reducing adoption friction when companies standardize on paid plans. By 2025, enterprise deals originating from grassroots free adoption converted at 40% higher rates than traditional sales-led approaches.

Long-Tail Revenue Opportunity

Freemium creates extended monetization windows. Users adopting products for simple use cases eventually expand into advanced scenarios triggering upgrade needs.

Statistical Evidence: Freemium products demonstrate 2x higher customer lifetime value compared to trial products when measuring 36-month cohorts, according to ProfitWell retention analysis.

Brand Awareness and Market Education

Millions of free users generate substantial brand awareness and market category education. This ambient marketing effect reduces acquisition costs for paid conversion.

Strategic Limitations

Free User Support Burden

Supporting free users consumes resources without direct revenue return. Support costs for freemium products average 20-30% of revenue compared to 12-15% for trial-based models.

Mitigation Strategy: Tiered Support Architecture

Support Level | Free Tier | Paid Tier | Cost Impact |

|---|---|---|---|

Documentation | Comprehensive self-serve | Same + video tutorials | Minimal incremental cost |

Community forums | User-to-user support | Priority responses | Moderate scaling cost |

Email support | None or delayed | 24-hour response SLA | Concentrated on revenue-generating customers |

Live chat | None | Real-time assistance | Premium resource allocation |

Phone support | None | Enterprise plans only | Highest-value segments only |

Conversion Blindness Risk

70% of free users never encounter upgrade prompts or dismiss them reflexively. Without strategic intervention, even high-value prospects remain on free tiers indefinitely.

Solution Framework: Progressive Engagement Gates

Effective freemium products implement soft gates that educate before restricting. For example, approaching storage limits trigger warnings: "You're using 85% of free storage. Upgrade to Pro for unlimited space plus advanced features."

This approach converts 3-5x higher than hard gates that simply block functionality without context or value communication.

Revenue Ramp Patience

Freemium requires substantial patience for revenue realization. Initial quarters show minimal revenue despite growing user bases, testing investor and stakeholder patience.

Expert Perspective: David Skok notes: "Freemium is a long game requiring conviction and capital. You're essentially building user value and dependency on credit, monetizing only when that value becomes mission-critical. This works brilliantly for products with strong network effects but fails for standalone tools."

Micro-Summary: Trials provide accelerated revenue, premium positioning, and predictable forecasting but face activation and payment friction challenges. Freemium enables viral growth, network effects, and long-tail value but requires massive scale, patient capital, and sophisticated conversion optimization to achieve sustainable unit economics.

Optimization Frameworks for Maximum Conversion

Trial Optimization Strategies

Maximizing trial conversion requires systematic optimization across activation, engagement, and conversion stages.

Activation Acceleration Techniques

Forced-Value Onboarding Paths

Rather than providing blank-slate access, guide users through structured value paths. Progressive checklists, interactive tutorials, and mandatory first-task completion dramatically improve activation rates.

Statistical Impact: Products implementing forced-value onboarding achieve 40-60% higher Day 3 retention compared to self-directed exploration, according to Userpilot onboarding analysis.

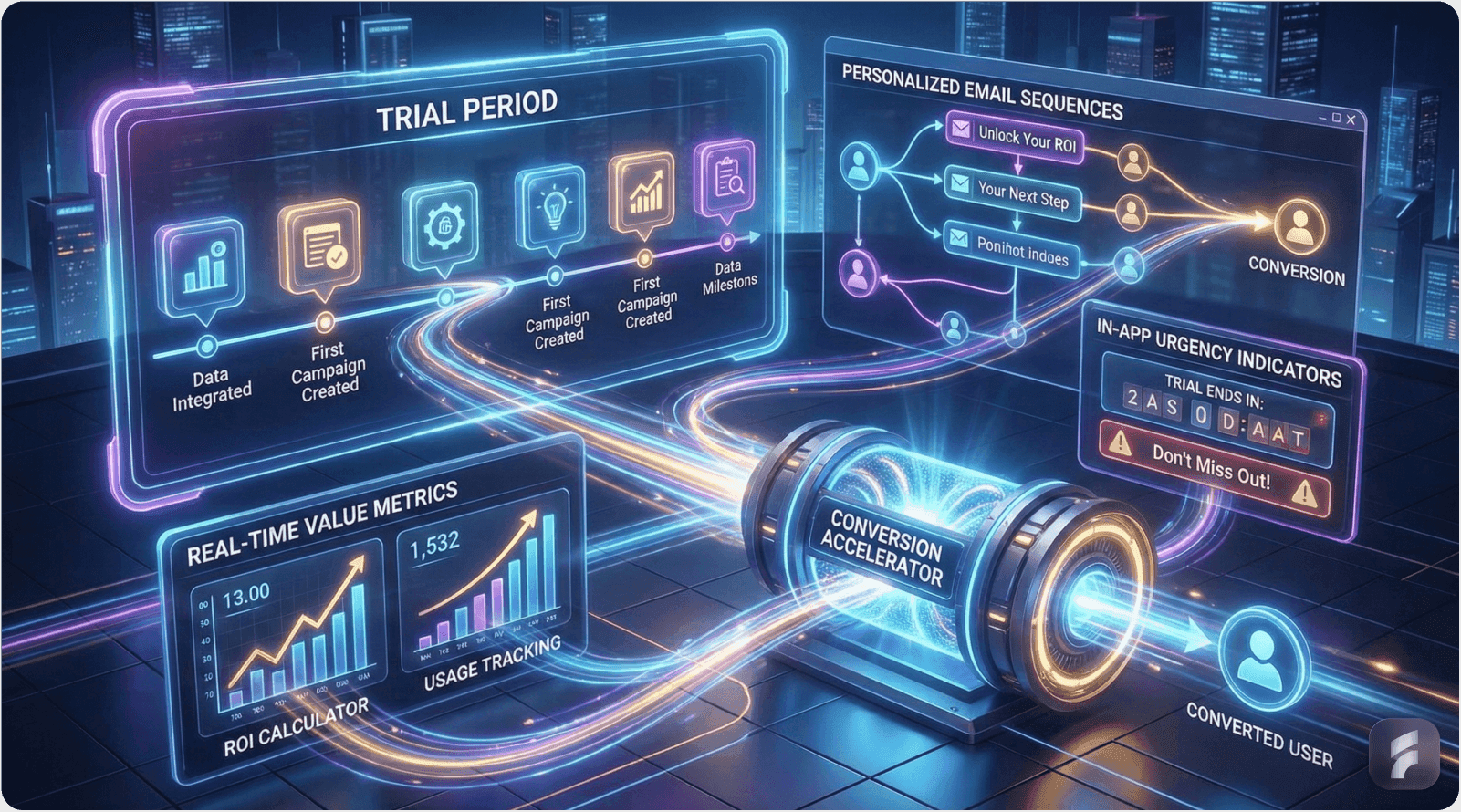

Personalized Email Sequences

Behavioral trigger-based emails outperform generic trial reminders. Messages referencing specific feature usage—"You used analytics 5 times—now try advanced segmentation"—convert 3-4x higher than time-based reminders.

Technical Implementation: Behavioral Cohorts

User Behavior | Email Trigger | Message Focus | Conversion Lift |

|---|---|---|---|

Completed setup, no core action | Hour 24 | Quick-win tutorial | 45% activation increase |

Used feature 3+ times | Day 3 | Advanced capability showcase | 35% feature adoption |

Invited team member | Day 5 | Collaboration value messaging | 60% team plan conversion |

Approaching trial end, high usage | Day 11 | ROI calculator + discount | 25% conversion increase |

Trial ended, no conversion | Day 15 | Extended trial or downgrade to limited free | 12% recovery rate |

In-App Urgency Mechanisms

Strategic urgency indicators—countdown timers, progress bars, value-received metrics—maintain conversion awareness without creating stress.

Products displaying daily value metrics ("You've saved 14 hours this week with automation") alongside trial countdowns achieve 28% higher conversion rates compared to time-only reminders.

Conversion Friction Reduction

One-Click Upgrade Experiences

Minimize steps between conversion intent and successful subscription. Pre-populate billing information, offer saved payment methods, and enable single-click plan selection.

Case Study: Monday.com Trial Optimization

Monday.com optimized trial conversion through systematic friction reduction:

Reduced checkout steps from 5 to 2 (plan selection → payment → confirmation)

Implemented saved payment methods for returning free/trial users

Added contextual upgrade CTAs within high-value features

Personalized plan recommendations based on team size and usage patterns

These optimizations collectively increased trial-to-paid conversion from 18% to 22%—a 22% relative improvement generating millions in incremental annual revenue.

Flexible Trial Extensions

Strategic trial extensions for engaged users who haven't converted prevent premature loss of qualified prospects. Users demonstrating high usage but slow decision-making benefit from additional evaluation time.

Data-Driven Approach: Extend trials automatically for users exceeding 75th percentile engagement but not yet converted, offering 3-7 additional days. This recovers 15-20% of otherwise-lost conversions.

Value Communication Optimization

ROI Calculators and Value Metrics

Quantify value delivered during trials. Time saved, revenue generated, efficiency gained—concrete metrics justify subscription costs.

Tools providing usage-based ROI reports ("Your team saved 47 hours and $2,350 in labor costs this trial period") convert at 40% higher rates than those relying on feature lists alone.

Freemium Optimization Strategies

Freemium optimization focuses on sustainable conversion without degrading free user experience.

Strategic Gating Architecture

Progressive Limitation Encounters

Rather than immediate restriction, implement graduated limitation exposure. Initial usage operates comfortably within free constraints, building satisfaction before encountering gates.

Gating Strategy Framework

Usage Stage | Free Tier Experience | Gate Trigger | Conversion Context |

|---|---|---|---|

Early adoption (Days 1-30) | Full feature access within limits | None—build habits | Focus on value delivery |

Active usage (Days 31-90) | Approaching limits with warnings | Soft gates with education | "You're a power user—unlock more" |

Power user (Days 90+) | Consistent limit encounters | Hard gates with alternatives | "Upgrade or optimize usage" |

Team expansion | Individual capabilities | Collaboration features | "Invite team with Pro plan" |

Contextual Upgrade Prompts

Generic "Upgrade Now" buttons convert at baseline rates. Contextual prompts tied to specific feature access or capability needs convert 3-5x higher.

Case Study: Notion's Contextual Conversion

Notion implements contextual gates when users attempt actions requiring upgrades:

Block limit prompts when creating 1,001st block (free tier limit)

Guest collaboration prompts when inviting 6th team member

Version history gates when attempting to restore previous edits

Advanced permission prompts for granular access control

These contextual triggers convert at 4.2% compared to 1.3% for generic upgrade prompts—a 223% improvement.

Learn more about effective UX optimization strategies to maximize conversions.

Engagement and Retention Mechanics

Habit Formation Loops

Successful freemium products create daily or weekly usage habits before introducing upgrade pressures. Regular engagement increases switching costs and upgrade willingness.

Statistical Evidence: Users establishing weekly habits convert to paid tiers at 3-4x the rate of sporadic users, according to retention research from Amplitude.

Value Milestone Celebrations

Recognize and celebrate user achievements—projects completed, documents created, milestones reached. These positive reinforcements build emotional attachment and upgrade receptivity.

Power User Identification and Targeting

Automatically identify users demonstrating high engagement, sophisticated usage patterns, or approaching limitation thresholds. Target these segments with personalized upgrade offers and premium feature trials.

Implementation Example: Flag users in top 20% of feature usage or approaching 80% of free tier limits. Offer personalized outreach: "We noticed you're getting serious value from [product]. Here's a 30-day Pro trial to unlock advanced capabilities."

This targeted approach converts 8-12% of identified power users compared to 2-5% baseline freemium conversion.

Viral Mechanism Optimization

Referral Program Design

Incentivize user acquisition through strategic referral rewards. Successful programs provide tangible value to both referrer and referee while aligning with product usage patterns.

Best Practice Framework:

Referrer reward: Feature unlocks, storage expansion, or subscription credits

Referee reward: Extended trial, bonus features, or immediate upgrades

Clear communication: Simple sharing mechanics and transparent reward structures

Social proof: Display successful referrals and community growth

Network Effect Amplification

Design product experiences that increase value with additional users. Collaboration features, content sharing, and multi-user workflows create natural invitation incentives.

Micro-Summary: Trial optimization focuses on rapid activation, behavioral engagement, and friction reduction at conversion, achieving 25%+ conversion through personalized journeys. Freemium optimization emphasizes progressive gating, contextual prompts, and viral mechanisms, targeting 4-6% conversion through volume and network effects.

Real-World Implementation Case Studies

Trial Model Success: Salesforce CRM Platform

Salesforce pioneered the trial model for enterprise CRM, establishing industry benchmarks for B2B SaaS evaluation.

Trial Structure: 30-day full-access trial with comprehensive onboarding

Implementation Characteristics:

Complete CRM functionality including automation, reporting, and integrations

Guided setup wizard customizing experience by industry and role

Proactive success team outreach for enterprise-tier trials

In-app value metrics tracking deals, activities, and productivity gains

Performance Results: While Salesforce doesn't publish specific trial conversion rates, industry parallels indicate enterprise CRM trials convert at 20-40% for qualified prospects. The extended 30-day period accommodates complex implementation, team training, and ROI demonstration.

Expert Analysis: Industry observers note Salesforce's trial success stems from comprehensive enablement—guided implementation, success team support, and clear value demonstration—rather than trial duration alone.

Key Optimization: Salesforce segments trial experiences by company size and industry, providing role-specific templates, workflows, and success metrics. This personalization improves activation and conversion across diverse customer segments.

Trial Model Success: Intercom Customer Messaging

Intercom provides customer messaging and engagement tools through 14-day trials targeting B2B teams.

Trial Structure: 14-day full-feature access with installation guidance

Implementation Approach:

Quick-install code snippet enabling rapid deployment

Pre-built message templates for common use cases

Real-time usage analytics showing customer engagement metrics

Conversion-focused email sequences highlighting ROI

Performance Metrics: Intercom achieves 18-25% trial-to-paid conversion for B2B segments, with higher rates among companies demonstrating strong engagement (5+ team members actively using platform during trial).

Success Factor: The 14-day window provides sufficient time for support teams to deploy chatbots, test automation, and measure customer satisfaction improvements—concrete value that justifies subscription costs.

Freemium Model Success: Slack Communication Platform

Slack revolutionized team communication through strategic freemium implementation, achieving 500+ million in annual recurring revenue by 2025.

Freemium Structure: Unlimited users with message history and integration limitations

Strategic Gates:

10,000 message search history (older messages remain but become unsearchable)

10 third-party integration limit (vs. unlimited on paid plans)

Group voice and video calls restricted to paid tiers

Advanced administrative controls gated for enterprise plans

Growth Metrics: By 2025, Slack reported that 80% of paid workspaces originated as free teams. The freemium model enabled grassroots adoption within organizations, with usage organically expanding until limitations justified paid upgrades.

Conversion Mechanics: Slack converts 8-10% of active free workspaces to paid plans, with conversion primarily triggered by:

Message history limitations affecting team productivity

Integration caps limiting workflow automation

Team growth necessitating administrative controls

Network Effect Power: Each additional team member increases Slack's value and switching costs. Free tier enables rapid user acquisition while network effects drive eventual monetization.

Expert Perspective: Stewart Butterfield, Slack CEO, explained: "We don't optimize for immediate conversion. We optimize for depth of adoption. Once a team relies on Slack for daily communication, the free tier limitations naturally create upgrade motivation without aggressive sales tactics."

Freemium Model Success: Canva Design Platform

Canva provides accessible design tools through freemium, reaching 60+ million monthly active users with 4-6% conversion to paid subscriptions.

Freemium Structure: Core design tools free with template and feature limitations

Strategic Gates:

Free templates alongside premium-only professional designs

Basic image library with premium stock photo access gated

Brand kit features (colors, fonts, logos) require paid plans

Team collaboration features restricted to Pro/Enterprise

Resize and format conversion tools limited on free tier

Conversion Approach: Canva implements visual contextual gates—users selecting premium templates encounter upgrade prompts with value explanations. This approach converts 25% higher than generic upgrade messaging.

Growth Results: Canva's freemium model enabled rapid market penetration, establishing category leadership in accessible design. The 4-6% conversion rate generates substantial revenue from massive user base while free users drive viral adoption through content sharing.

Optimization Innovation: Canva introduced "Canva Pro Trial" offering 30-day premium access to engaged free users. This hybrid approach—freemium for acquisition, trial for conversion—accelerates monetization while preserving accessibility.

Hybrid Model Innovation: Notion Workspace Platform

Notion demonstrates hybrid model sophistication, combining freemium for individual users with trial mechanics for team features.

Hybrid Structure:

Unlimited blocks for personal use (permanently free)

Team collaboration features with guest limitations

Advanced features (version history, advanced permissions) as trial-eligible upgrades

Strategic Implementation: Individual users adopt Notion freely for personal productivity. As usage matures or team collaboration needs emerge, gates appear:

5 guest limit on free personal workspaces

Version history limited to 7 days (vs. 30 days on paid plans)

Advanced permissions unavailable for free users

Conversion Performance: Personal free users convert at 3-5%, while team workspaces convert at 12% when encountering collaboration limits. This tiered conversion reflects different value propositions and use case economics.

Innovation Insight: Notion's model recognizes different customer segments require different conversion mechanics. Individual users need freemium permanence, while team scenarios justify trial-style feature gating.

For insights on designing effective user experiences, explore our product design services.

Micro-Summary: Successful implementations share common characteristics: strategic limitation design aligned with customer value realization, comprehensive onboarding reducing activation friction, and data-driven optimization of conversion touchpoints. The optimal model and structure depend on product complexity, target market, and growth strategy.

Comparative Performance Analysis

Conversion Funnel Metrics

Understanding complete funnel economics enables informed model selection and optimization prioritization.

Comprehensive Funnel Comparison

Stage | Opt-In Trial | Opt-Out Trial | Freemium | Strategic Implication |

|---|---|---|---|---|

Website visitors | 10,000 | 10,000 | 10,000 | Baseline traffic |

Signup conversion | 7.5% (750) | 2.5% (250) | 14% (1,400) | Freemium maximizes acquisition |

Activation rate | 40% (300) | 60% (150) | 35% (490) | Opt-out attracts higher intent |

Conversion to paid | 17% (51) | 48% (72) | 3% (42) | Opt-out maximizes paid conversion |

Overall conversion | 0.51% | 0.72% | 0.42% | Opt-out highest quality, freemium highest volume |

Economic Efficiency Analysis

Assuming $50 monthly ACV and $15 cost per signup (trials) or $5 per signup (freemium):

Opt-In Trial Economics:

750 signups × $15 = $11,250 acquisition cost

51 paid customers × $50 = $2,550 first-month revenue

Payback period: 4.4 months

Opt-Out Trial Economics:

250 signups × $15 = $3,750 acquisition cost

72 paid customers × $50 = $3,600 first-month revenue

Payback period: 1.0 month

Freemium Economics:

1,400 signups × $5 = $7,000 acquisition cost

42 paid customers × $50 = $2,100 first-month revenue

Payback period: 3.3 months

Ongoing support cost: $2,800/month (1,358 free users × $2)

This analysis reveals opt-out trials provide fastest payback despite lower volume, while freemium generates ongoing costs requiring long-term LTV justification.

Time-to-Revenue Comparison

Revenue realization timing significantly impacts cash flow, growth rate, and investor appeal.

Revenue Recognition Timeline

Model | Average Time to First Payment | Median Subscription Length Before Churn | LTV Realization Speed |

|---|---|---|---|

Opt-In Trial | 16 days | 18 months | Moderate |

Opt-Out Trial | 8 days | 22 months | Fast |

Freemium | 127 days | 28 months | Slow |

Statistical Evidence: Trial models achieve 50% of customer lifetime value within 6 months, while freemium requires 18 months for equivalent value realization, according to ChartMogul cohort analysis.

Strategic Implications:

Trial models enable faster growth loops—revenue funds acquisition for next cohort

Freemium requires patient capital tolerating extended payback periods

Opt-out trials optimize for capital efficiency and growth velocity

Freemium optimizes for market share and defensive positioning

Retention and LTV Analysis

Long-term customer value often differs substantially from first-year revenue, influencing model selection.

Customer Lifetime Value Comparison

Trial-Acquired Customers:

Average LTV: $1,200 (24 months × $50)

Churn rate: 4-5% monthly (annual retention ~60%)

Expansion revenue: 15% of cohort upgrades to higher tiers

Freemium-Acquired Customers:

Average LTV: $1,680 (28 months × $60 after upgrades)

Churn rate: 3-4% monthly (annual retention ~65%)

Expansion revenue: 25% of cohort upgrades to higher tiers

Expert Analysis: While trials convert faster, freemium customers demonstrate higher retention and expansion due to longer pre-purchase product familiarity and gradual commitment escalation.

Micro-Summary: Opt-out trials maximize capital efficiency and growth velocity with 1-month payback periods, while freemium optimizes for market share and long-term LTV despite 3+ month payback. Model selection should prioritize strategic objectives—rapid growth versus market dominance—rather than solely optimizing immediate conversion metrics.

Strategic Decision Framework

Product Characteristic Assessment

Systematic product evaluation guides optimal model selection based on intrinsic characteristics rather than competitor imitation.

Complexity and Learning Curve

High-Complexity Indicators (favor trials):

Requires 3+ hours initial configuration

Involves multiple system integrations

Necessitates workflow redesign or behavioral change

Demands team training or organizational adoption

Provides value through sophisticated features rather than simplicity

Low-Complexity Indicators (favor freemium):

Delivers value within 5 minutes of signup

Requires minimal configuration or learning

Provides immediate gratification or utility

Enables intuitive, self-directed usage

Succeeds through simplicity rather than comprehensiveness

Assessment Question: Can users experience transformational value within 48 hours without assistance?

Yes → Freemium viable

No → Trial recommended

Value Delivery Mechanism

Depth-First Value (favor trials): Products where value increases with feature sophistication, integration depth, or workflow customization benefit from unrestricted trial access demonstrating premium capabilities.

Breadth-First Value (favor freemium): Products where value comes from network effects, content volume, or multi-user collaboration benefit from wide adoption before monetization.

Network Effect Evaluation

Network Effect Strength | Model Recommendation | Rationale |

|---|---|---|

None (standalone tool) | Trial | No viral benefit from free users |

Weak (optional sharing) | Trial or Hybrid | Limited network value |

Moderate (team collaboration) | Freemium or Hybrid | Free users create paid user value |

Strong (platform/marketplace) | Freemium | Network effects essential to value |

Market and Customer Analysis

Target market characteristics fundamentally influence conversion model effectiveness.

Customer Segment Characteristics

Enterprise and Mid-Market B2B (favor trials):

Long sales cycles (60+ days) accommodate trial periods

High deal values ($5K+ ACV) justify sales investment

Multiple stakeholder evaluation requires comprehensive access

Risk aversion demands proof-of-concept before commitment

Purchasing authority concentrated in budget-holders

SMB and Consumer (favor freemium):

Short decision cycles demand instant value

Low ACVs ($10-50/month) require volume economics

Individual decision-making enables rapid adoption

Price sensitivity necessitates zero-commitment entry

Self-serve purchasing expectations

Statistical Guidance: Products with ACV above $50 monthly convert 40-60% better with trials; below $20 monthly perform better with freemium, according to ProfitWell segmentation analysis.

Competitive Landscape Considerations

Established Category with Incumbent Leaders (favor freemium): Market leaders with trial models create opportunity for freemium disruption. Zero-commitment entry reduces switching barriers and enables grassroots adoption.

Emerging Category Requiring Education (favor trials): New product categories benefit from trials enabling comprehensive evaluation and value proof during market education phase.

Expert Perspective: David Skok advises: "In crowded markets, differentiate through conversion model innovation. If competitors all use trials, freemium creates competitive advantage. The reverse holds in freemium-saturated markets."

Operational Readiness Assessment

Model success depends on organizational capabilities supporting required customer experiences.

Required Capabilities for Trial Success

Onboarding Excellence:

Interactive tutorials and guided workflows

Contextual help and documentation

Rapid support responsiveness for trial users

Automated engagement campaigns

Value Demonstration:

ROI calculators and value metrics

Success milestones and achievement tracking

Comparative analytics showing improvement

Use case templates and examples

Conversion Optimization:

Behavioral analytics and segmentation

Personalized messaging infrastructure

Frictionless payment processing

Lifecycle email automation

Required Capabilities for Freemium Success

Scalable Support Infrastructure:

Comprehensive self-serve documentation

Community forums and peer support

Automated onboarding sequences

Tiered support limiting free user burden

Progressive Gating Design:

Strategic feature limitation architecture

Contextual upgrade prompts and messaging

Usage monitoring and threshold alerts

Conversion funnel optimization

Viral Growth Mechanisms:

Referral program infrastructure

Social sharing integrations

Network effect design

Collaboration features driving multi-user adoption

Assessment Framework: Organizations should evaluate readiness across these dimensions before committing to conversion models. Inadequate capabilities undermine model effectiveness regardless of product-market fit.

Micro-Summary: Optimal model selection requires systematic assessment of product complexity, value delivery mechanism, target market characteristics, competitive positioning, and organizational capabilities. Strategic alignment across these dimensions determines conversion model success more than any single factor.

Implementation and Testing Strategy

Controlled Experimentation Approach

Rather than wholesale model commitment, strategic testing mitigates risk and provides empirical validation.

Split-Testing Framework

Traffic Segmentation Strategy: Allocate 10-20% of traffic to alternative model testing while maintaining primary conversion path for majority of users. This approach provides statistical significance while limiting exposure to suboptimal experiences.

Testing Protocol:

Hypothesis Formation: Define specific performance predictions for alternative model

Cohort Definition: Segment users by acquisition channel, geography, or company size

Metrics Specification: Establish primary (conversion rate) and secondary (LTV, retention) success criteria

Duration Planning: Run tests for minimum 2-4 weeks capturing complete conversion cycles

Statistical Validation: Ensure adequate sample size for significance (typically 100+ conversions per variant)

Case Study: Amplitude's Model Testing

Amplitude, an analytics platform, systematically tested trial variants:

Control: 30-day opt-in trial

Variant A: 14-day opt-in trial with extension offers

Variant B: 14-day opt-out trial with card requirement

Variant C: Freemium with limited events plus premium trial

Results revealed 14-day opt-in trials with strategic extensions achieved optimal balance—higher signup rates than opt-out while maintaining strong conversion through targeted extensions for engaged users.

Hybrid Model Implementation

Progressive organizations implement hybrid approaches combining trial and freemium mechanics.

Hybrid Architecture Patterns

Freemium-to-Trial Progression:

Core functionality permanently free (freemium)

Advanced features available through time-limited trials

Conversion occurs after trial demonstrates premium value

Example: Canva's free design tools with Pro feature trials for engaged users

Tiered Freemium with Trial Upgrades:

Multiple free usage tiers with progressive limitations

Trial access to higher tiers for users approaching limits

Conversion based on sustained usage exceeding free tier capabilities

Example: Notion's unlimited personal use with team feature trials

Conditional Trial Access:

Freemium as default entry

Trial offered based on usage patterns, company characteristics, or strategic segments

Personalized conversion paths optimizing for different customer profiles

Statistical Performance: Hybrid models achieve median conversion rates of 4-7%—between pure freemium (2-5%) and trials (17-18%)—while combining volume benefits of freemium with urgency of trials.

Migration and Transition Strategy

Organizations evolving from one model to another require careful migration planning preserving existing customer relationships.

Trial-to-Freemium Migration

Grandfathering Strategy: Maintain trial access for users who signed up under previous model while introducing freemium for new users. This prevents customer frustration while enabling model evolution.

Communication Framework:

Announce model change with clear value explanation

Provide transition period for existing trial users

Offer special conversion incentives during migration

Maintain support resources for both models during transition

Freemium-to-Trial Migration

User Segmentation Approach: Convert to trial model selectively, maintaining freemium for consumer segments while introducing trials for enterprise users. This preserves viral growth while optimizing B2B conversion.

Risk Mitigation:

Test trial model with new user cohorts first

Maintain freemium indefinitely for existing users

Monitor churn and feedback during transition

Provide path for trial-to-freemium downgrade if needed

Micro-Summary: Strategic implementation requires controlled testing validating model effectiveness before full commitment, consideration of hybrid approaches combining benefits of both models, and careful migration planning when evolving conversion architecture to preserve customer relationships and business continuity.

Future Trends and Emerging Patterns

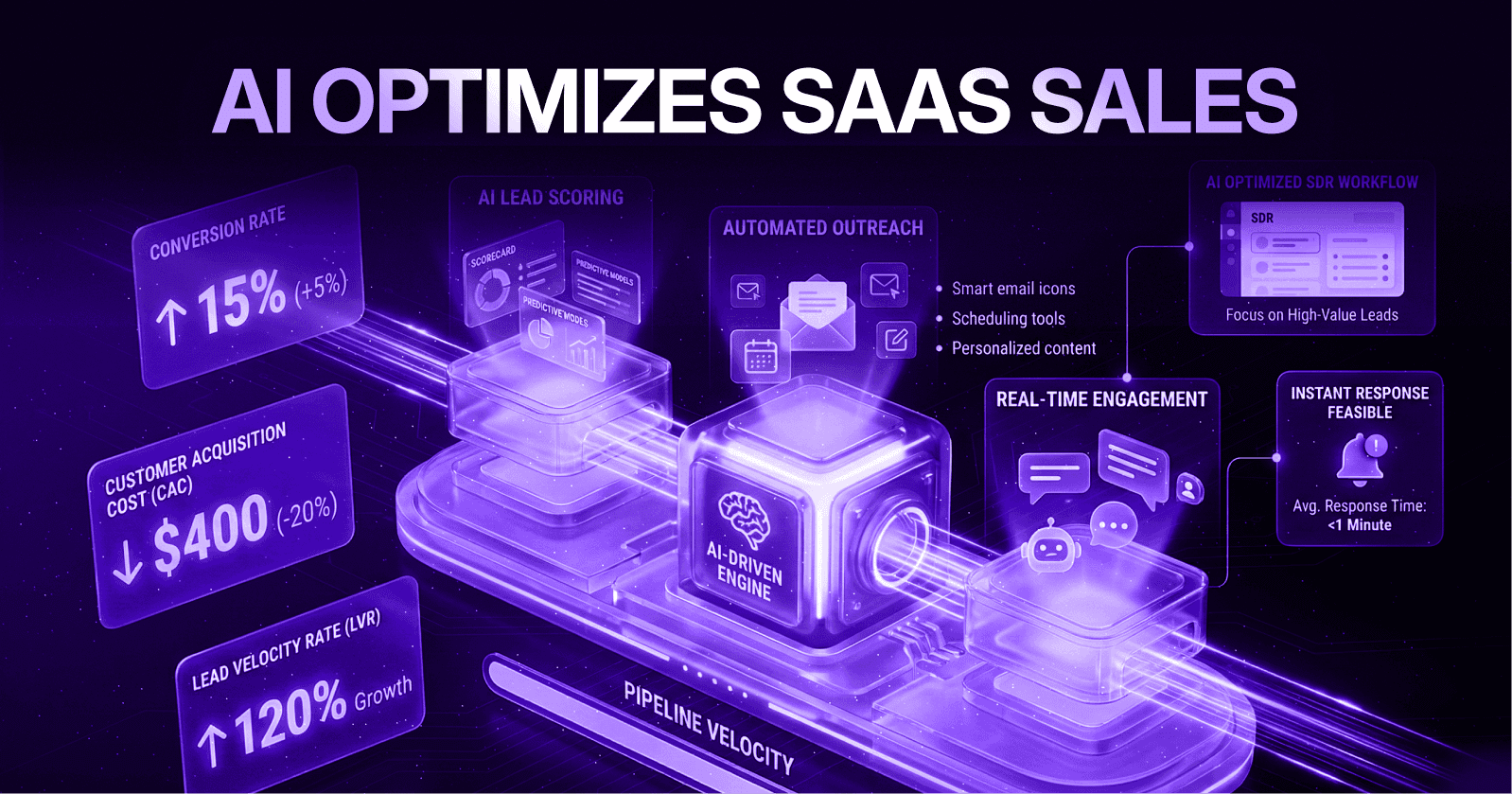

AI-Powered Personalization

Artificial intelligence enables unprecedented conversion optimization through individualized experiences.

Adaptive Trial Lengths

Machine learning models analyze user behavior, company characteristics, and engagement patterns to optimize trial duration dynamically. High-engagement users receive shorter trials with urgency, while complex implementations receive automatic extensions.

Statistical Impact: AI-optimized trial lengths improve conversion rates by 25-40% compared to fixed-duration trials, according to early implementations by companies like Userpilot and Appcues.

Predictive Feature Gating

AI systems identify which features drive conversion for specific user segments, dynamically adjusting freemium gates to maximize monetization while preserving engagement.

Expert Analysis: Industry observers predict that by 2027, leading SaaS companies will implement fully dynamic pricing and feature availability based on individual propensity-to-pay models and usage patterns.

Product-Led Growth Dominance

The shift toward product-led growth accelerates trial and freemium adoption across previously sales-led segments.

Market Evolution Statistics:

65% of SaaS companies now offer trial or freemium models (up from 45% in 2020)

PLG companies grow 30-50% faster than sales-led counterparts

Average sales cycle length decreased 40% with trial/freemium introduction

Emerging Pattern: Enterprise software increasingly offers freemium developer tiers or trial access alongside traditional sales motions, creating dual-track growth engines.

Usage-Based Pricing Integration

Conversion models increasingly integrate with usage-based pricing, creating hybrid monetization approaches.

Consumption-Aligned Gates

Rather than static feature limitations, freemium tiers impose consumption constraints—API calls, storage, compute time—that naturally escalate with value realization.

Case Study: Snowflake's Consumption Model

While not pure freemium, Snowflake's consumption-based pricing creates trial-like dynamics where initial usage remains minimal, automatically scaling charges as value and dependency grow.

Strategic Advantage: Usage-based models eliminate conversion friction—users never "upgrade" but automatically pay more as usage increases, reducing psychological barriers while improving unit economics.

Community-Driven Conversion

Product communities and peer networks increasingly influence conversion decisions.

Community Mechanics:

Free tier users participate in forums, creating content and providing support

Paid users gain privileged access to expert communities and exclusive content

Community engagement correlates with 2-3x higher conversion rates

Implementation Example: Developer tools like GitHub create community value through public repositories and collaboration, with private repositories and advanced features gating monetization.

For more insights on modern SaaS strategies, explore our blog.

Micro-Summary: Future conversion optimization leverages AI personalization for individualized trial lengths and feature gating, integrates with product-led growth strategies combining bottom-up adoption with top-down sales, and incorporates usage-based pricing eliminating traditional upgrade friction while aligning revenue with value realization.

Conclusion: Strategic Model Selection for Sustainable Growth

The choice between trials and freemium fundamentally shapes SaaS growth trajectories, unit economics, and competitive positioning. Neither model universally superior—optimal selection depends on systematic alignment between product characteristics, market dynamics, and organizational capabilities.

Core Decision Principles:

Complex B2B products with high ACVs, extended learning curves, and enterprise target markets benefit from trial models. The time-constrained full access demonstrates comprehensive value, supporting premium positioning and accelerated revenue recognition. Opt-out trials with credit card requirements maximize conversion quality and capital efficiency for organizations prioritizing growth velocity.

Simple, viral products targeting SMB or consumer markets with strong network effects succeed through freemium models. Zero-friction entry enables rapid user acquisition and market penetration while free users provide network value to paid customers. Successful freemium requires massive scale, patient capital, and sophisticated conversion optimization achieving 4%+ free-to-paid rates.

Hybrid approaches combining freemium acquisition with premium feature trials represent increasingly sophisticated implementation strategies. These models capture volume benefits of freemium while maintaining conversion urgency of trials, particularly effective for products with tiered value propositions serving multiple market segments.

Implementation Excellence Requirements:

Regardless of model selection, success depends on execution excellence across critical capabilities. Trial success requires exceptional activation support achieving 25%+ Day 3 engagement, behavioral personalization delivering contextual value communication, and frictionless conversion experiences minimizing payment abandonment.

Freemium success demands strategic limitation architecture creating natural upgrade triggers without degrading free experience, viral growth mechanisms enabling sustainable user acquisition, and scalable support infrastructure preventing free user cost overload.

Measurement and Optimization Discipline:

Conversion model optimization never concludes. Continuous experimentation—A/B testing trial lengths, iterating gate strategies, refining messaging—drives incremental improvements compounding to substantial advantage. Organizations should establish baseline metrics, implement systematic testing protocols, and maintain rigorous analytics tracking activation, engagement, and conversion across customer segments.

Future-Proofing Strategy:

The convergence of AI personalization, product-led growth, and usage-based pricing will continue reshaping conversion models. Forward-looking organizations build flexible architectures enabling rapid model evolution and integration of emerging capabilities while maintaining focus on fundamental principles: rapid value demonstration, friction reduction, and alignment between customer success and revenue realization.

The optimal conversion model aligns product economics with customer psychology, organizational capabilities with market dynamics, and immediate revenue needs with long-term strategic positioning. Systematic assessment, controlled experimentation, and disciplined execution determine success far more than any theoretical model superiority.

For expert guidance on optimizing your SaaS conversion strategy and user experience, visit Saasfactor or explore our comprehensive UX audit services.

Glossary: Conversion Model Terminology

Activation Rate: Percentage of signups completing meaningful first actions demonstrating value realization. Critical success predictor—products with 40%+ Day 3 activation convert 3-4x better than those below 25%.

Average Contract Value (ACV): Mean annual revenue per customer. Products with ACV above $600 annually ($50/month) typically perform better with trials, while below $240 annually freemium often succeeds.

Churn Rate: Percentage of customers canceling subscriptions monthly. Trial-acquired customers average 4-5% monthly churn while freemium-acquired customers show 3-4% due to longer pre-purchase engagement.

Conversion Funnel: Complete path from initial awareness through paid subscription. Understanding stage-specific drop-off enables targeted optimization addressing specific friction points.

Customer Acquisition Cost (CAC): Total sales and marketing expense divided by new customers acquired. Includes advertising, content, salaries, and tools but should also incorporate free user support costs for freemium models.

Customer Lifetime Value (LTV): Total revenue generated from average customer over relationship duration. Calculated as average monthly revenue divided by monthly churn rate, multiplied by gross margin.

Freemium: Business model providing permanent core functionality access with feature, usage, or capacity limitations encouraging eventual paid upgrades. Optimizes for volume over immediate monetization.

Network Effect: Phenomenon where product value increases with additional users. Strong network effects favor freemium models as free users provide value to paid customers, justifying support costs.

Opt-In Trial: Trial requiring only email signup, collecting payment at conversion. Converts 7-8% of visitors to trials and 17-18% trials to paid—0.51% overall conversion.

Opt-Out Trial: Trial requiring credit card upfront with automatic conversion unless canceled. Converts 2-3% visitors to trials and 48-50% trials to paid—0.72% overall conversion.

Product-Led Growth (PLG): Go-to-market strategy where product experience drives acquisition, conversion, and expansion rather than sales or marketing. Trials and freemium enable PLG approaches.

Progressive Gating: Strategic limitation implementation where users initially operate comfortably within free constraints before encountering gates. Creates positive early experiences while maintaining upgrade incentives.

Time-to-Value (TTV): Duration from signup to first meaningful value realization. Products with sub-5-minute TTV succeed with freemium while longer TTV favors trials providing evaluation runway.

Viral Coefficient: Average number of new users generated by each existing user through referrals, sharing, or collaboration invitations. Coefficients above 1.0 enable exponential growth.

Usage-Based Gating: Freemium limitation strategy restricting consumption metrics (storage, API calls, users) rather than features or time. Creates natural upgrade triggers aligned with value realization.

References and Authoritative Sources

Research Institutions and Data Sources

McKinsey & Company - SaaS Growth Strategies and Conversion Model Analysis

ProfitWell - SaaS Metrics Report - Conversion Benchmarks by Model Type

ChartMogul - SaaS Customer Lifetime Value and Cohort Analysis

FirstPageSage - Freemium and Trial Conversion Benchmark Data

Totango - SaaS Customer Success and Retention Metrics Report

SaaS Capital - Annual SaaS Survey Results and Financial Benchmarks

Userpilot - Product Onboarding and Activation Best Practices

CrazyEgg - Conversion Rate Optimization and Model Comparison

The Bridge Group - Inside Sales Development Metrics and Benchmarks

Amplitude - Product Analytics and Retention Research

Harvard Business Review - Behavioral Economics and Pricing Strategy

MIT - Dan Ariely: Predictably Irrational - Behavioral Economics Research

Industry Thought Leaders and Experts

David Skok (Matrix Partners) - SaaS Metrics and Business Model Analysis

Hiten Shah (Nira) - Product-Led Growth and Freemium Strategy

Elena Verna (Consultant) - Growth Strategy and Conversion Optimization

Stewart Butterfield (Slack) - Product-Led Growth and Network Effects

Lincoln Murphy - Customer Success and Trial Optimization Strategies

SaaS Companies Featured in Case Studies

Salesforce - Enterprise CRM trial model

Intercom - B2B messaging platform trial strategy

Slack - Freemium communication platform

Canva - Design tool freemium model

Dropbox - File storage freemium strategy

Notion - Hybrid workspace platform

Monday.com - Trial optimization case study

Snowflake - Usage-based pricing integration

GitHub - Community-driven conversion

Appcues - AI-powered personalization