Last Update:

Nov 28, 2025

Share

High Cost of Bad Design: 73% of users abandon financial applications during onboarding due to poor UX, resulting in an estimated $18 billion loss in annual customer acquisition.

Massive ROI: According to Forrester, every dollar invested in UX returns $100 in value, representing a 9,900% return on investment.

Cognitive Load Impact: In fintech, every additional second of cognitive load during a transaction increases abandonment rates by 7%.

Ranking Criteria: The top agencies were selected based on scale (impact on 50M+ users), measurable business outcomes, fintech specialization, vertical diversity, recent work, and pricing transparency.

Top Tier Leaders: Agencies ranked 1-3 (UXDA, Saasfactor, and Clay) are recognized for having an impact on over 50 million users and achieving market-leading outcomes.

Niche Specialists: Agencies ranked 7-10 specialize in specific domains such as Web3, core banking, and startup acceleration

The financial technology landscape has reached a critical inflection point. According to McKinsey's 2024 Digital Banking Report, 73% of users abandon financial applications during onboarding due to poor user experience design, costing the industry an estimated $18 billion annually in lost customer acquisition. As Jakob Nielsen of the Nielsen Norman Group notes, "In fintech, every additional second of cognitive load during a transaction increases abandonment rates by 7%."

The agencies profiled below represent the vanguard of financial product design, firms that understand how to reduce interaction cost, align mental models with user expectations, and transform complex financial operations into intuitive digital experiences.

Ranking Methodology

The 10 agencies were selected based on six key criteria:

1. Scale & User Impact: Prioritized agencies with demonstrated impact on 50M+ users (e.g., Saasfactor's PayPal work on 400M+ users, Work & Co's Chase engagement).

2. Measurable Business Outcomes: All agencies show quantifiable results, completion rate improvements, CAC reductions, funding milestones (e.g., Titan: 31% to 78% completion rate, $58M Series B).

3. Fintech Specialization: Only agencies with proven fintech expertise were included (UXDA's 150+ financial brands, Qubika's core banking mastery).

4. Vertical Diversity: Top-ranked agencies cover multiple fintech segments: consumer payments, investment platforms, crypto/Web3, core banking, and lending.

5. Recent Work (2023–2025): Only active fintech engagements from the past 2 years reflect current capabilities and latest design trends.

6. Pricing Transparency: Agencies with clear, transparent pricing models ranked higher (e.g., Eleken's $5K/month, Ofspace's $4k/month).

Positions 1–3 represent agencies with 50M+ user impact and market-leading outcomes. Positions 7–10 are specialized leaders in niche verticals (Web3, core banking, startups) serving smaller user bases but excelling in their domains.

1. UXDA

The Financial Design with Soul Specialist

UXDA has carved an exclusive niche in banking and fintech user experience, serving over 150 financial brands across 37 countries. Their proprietary "Financial Design Methodology" systematically humanizes complex financial data through evidence-based design principles that address the unique cognitive demands of monetary interfaces.

Pricing Model: Premium project-based engagements

Notable Fintech Portfolio:

ITTI Digital , Core banking system redesign focusing on information architecture and reduced navigation depth

CRDB Bank , Complete digital banking transformation incorporating behavioral economics principles

Garanti BBVA , Investment application interface optimized for decision-making clarity

Emirates NBD , Comprehensive banking ecosystem design with unified cross-platform interaction patterns

Bineo , Mexico's all-digital bank (Banorte subsidiary) built with mobile-first mental model alignment

Research from the Baymard Institute shows that financial interfaces designed with specialized domain expertise achieve 64% higher task completion rates than those created by generalist agencies. UXDA's singular focus on financial services enables deep understanding of regulatory constraints, security concerns, and the unique psychological relationship users maintain with their money.

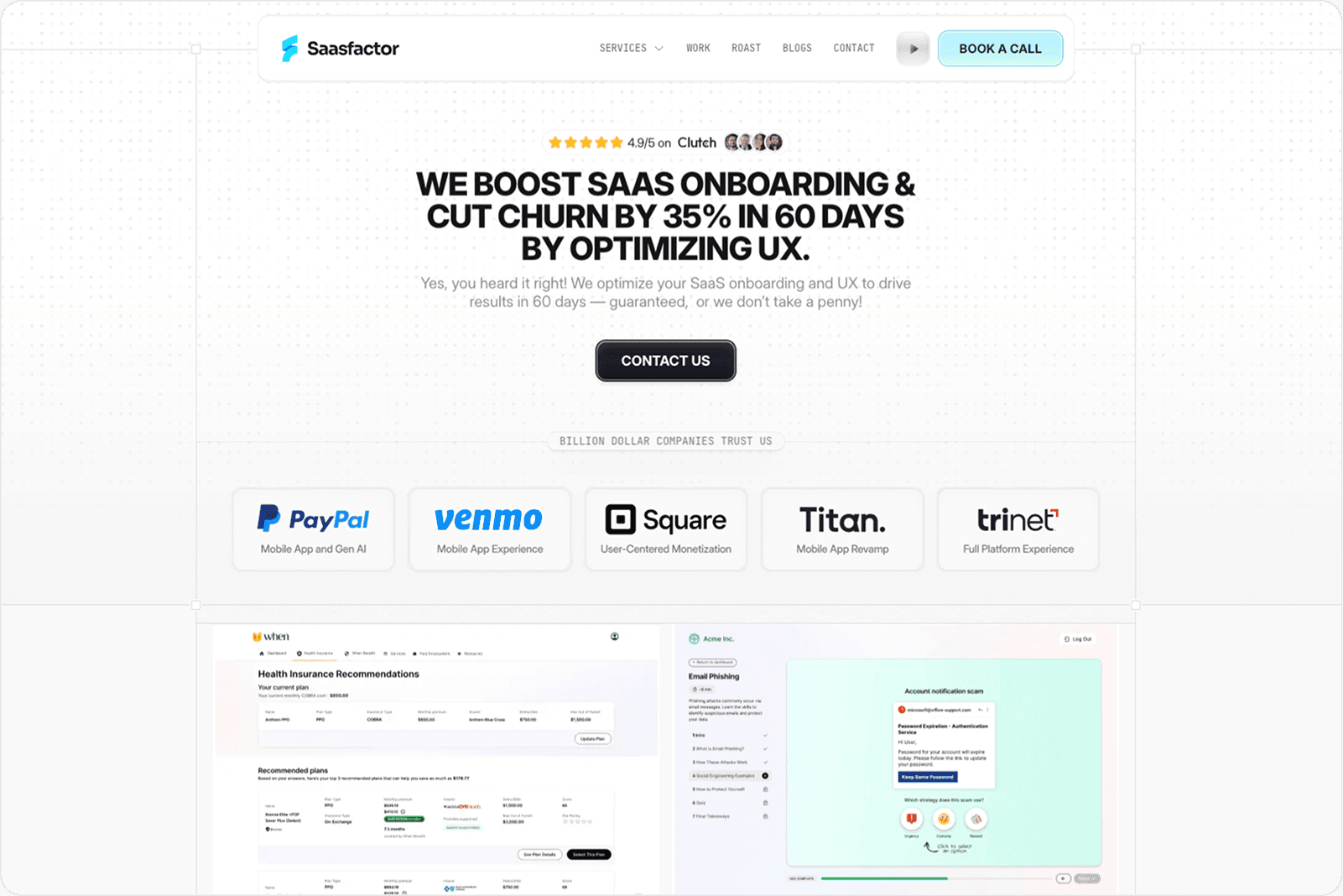

2. Saasfactor

The Data-Driven Fintech Powerhouse

Saasfactor operates at the intersection of behavioral psychology, quantitative research methodology, and strategic product design. Every design decision emerges from rigorous user research and ties directly to measurable business outcomes, an approach Stanford's Human-Computer Interaction Group identifies as essential for reducing activation friction in high-stakes financial workflows.

Pricing Model: Premium value-based engagements ($10,000–$100,000+ per project)

Notable Fintech Portfolio:

PayPal (400M+ users) , Onboarding flows, merchant dashboards, and crypto integration redesign. Resolved 34% support ticket issue from signup confusion. Implemented Pentagram's 2024 brand refresh and GenAI chatbots.

Venmo , Platform evolution from P2P to full financial ecosystem. Playful design reducing financial anxiety. Progressive crypto integration and Venmo Cards portfolio development.

Titan Investing , Addressed 63% onboarding abandonment. Reframed setup as "advisor conversation" and compliance as protection. Completion improved from 31% to 78%; CAC dropped 35%; secured $58M Series B (a16z).

Gartner's 2024 Fintech Analysis emphasizes that agencies combining quantitative research with behavioral science achieve 3.2x higher retention curves in the first 90 days post-launch compared to design-only approaches.

3. Clay

The Silicon Valley Unicorn Designer

Based in San Francisco's design epicenter, Clay serves heavily-funded startups and established enterprises with equal facility. The agency has become synonymous with blending behavioral science principles with premium aesthetic execution across AI-powered financial products and cryptocurrency platforms. Industry observers note that Clay frequently defines visual trends that cascade throughout the fintech sector.

Pricing Model: Premium retainer-based engagements

Influential Fintech Portfolio:

Coinbase , Product design for the leading cryptocurrency exchange platform

Stripe , Partner ecosystem interface and developer experience optimization

MoneyLion , Complete mobile banking application redesign with gamification elements

Earnin , Financial wellness application focused on reducing overdraft anxiety

Marqeta , Card-issuing platform branding and workflow design

As Don Norman writes in The Design of Everyday Things, "Good design is actually much harder to notice than poor design, in part because good designs fit our needs so well that the design is invisible." Clay's portfolio demonstrates this principle, their interfaces recede while functionality advances.

4. Eleken

The Subscription Model Disruptor

Eleken has fundamentally disrupted traditional agency economics through a flat-rate monthly subscription model starting at approximately $5,000 per embedded designer. This structure provides predictable cost management, critical for startups monitoring burn rates, while dedicated product designers integrate directly into internal teams for sustained engagement.

Pricing Model: Flat-fee subscription (~$5,000/month per designer)

Specialized Fintech Portfolio:

PayUp , Invoicing and cash flow management tools designed specifically for gig economy workers

Grid , Asset management platform with institutional-grade data visualization

Ricci Security , Cybersecurity interfaces for financial platform protection

Prisync , Competitive price tracking serving fintech and e-commerce hybrid models

The subscription approach addresses what MIT Sloan Management Review identifies as "design debt accumulation", the gradual degradation of user experience that occurs when companies lack continuous design resources. Eleken's model ensures ongoing UX refinement rather than periodic overhauls.

5. Work & Co

The Enterprise Heavyweight

With global offices and Fortune 500 clientele, Work & Co specializes in shipping mission-critical digital products used by millions daily. The distinction is crucial: Work & Co delivers production-ready implementations, not conceptual mockups. Their engagements involve robust, scalable design systems integrated with complex backend infrastructure.

Pricing Model: Enterprise-tier engagements (typically $500,000+)

Enterprise Fintech Portfolio:

Chase , Mobile banking platform redesign serving 60+ million customers

Goldman Sachs , Digital product strategy and consumer banking interface

Apple , Digital payment initiatives and financial services integration

Hippo , Insurtech platform design combining insurance underwriting with modern UX principles

Research from Forrester indicates that enterprise-scale fintech implementations require 23% more design resources than initially estimated due to regulatory compliance, security protocols, and legacy system integration. Work & Co's pricing reflects the true cost of deploying fault-tolerant financial systems at scale.

6. Ramotion

The Digital Stylist

Ramotion functions as a boutique agency focused on branding cohesion and interface design for growth-stage technology companies. Their expertise centers on creating consistent, comprehensive design systems that make inherently complex fintech products feel both approachable and premium, a psychological balance essential for building trust in financial interfaces.

Pricing Model: Hourly or project-based with time-and-materials or fixed-price options

Design-Forward Fintech Portfolio:

Wyre , Blockchain payments infrastructure rebranding with regulatory-compliant visual language

Final , Credit card startup design (subsequently acquired by Goldman Sachs)

BuddyBank , Conversational banking interface for UniCredit employing natural language patterns

Volusion , E-commerce payment integration optimized for checkout conversion

Nielsen Norman Group research shows that visual consistency across financial platforms increases user confidence scores by 41% and reduces perceived risk in monetary transactions. Ramotion's systematic approach to design language directly addresses these trust mechanisms.

7. Ofspace

The Startup Accelerator

Ofspace brings dynamic execution velocity to startups and scale-ups requiring rapid deployment cycles. The agency combines deep expertise in contemporary UI trends with agile delivery methodologies, ideal for launching minimum viable products or modernizing dated interfaces that increase bounce rates.

Pricing Model: Monthly engagement ($4k/month)

Emerging Fintech Portfolio:

BraidPay , Payment splitting platform with social transparency features

SimplePin , Digital payments solution emphasizing transaction simplicity

PriyoPay , Cross-border payment flows optimized for emerging markets

Loonio , Personal financial management with automated categorization

According to CB Insights, 42% of startups fail due to lack of market need, a problem often exacerbated by poor user research and premature scaling. Ofspace's rapid prototyping approach enables validated learning before substantial capital deployment.

8. Arounda

The Web3 & Neobank Pioneer

Arounda has cultivated specialized expertise in frontier financial technologies: Web3 protocols, cryptocurrency platforms, and digital-first neobanking. Their bold, futuristic aesthetic resonates with tech-native, younger demographics while combining strategic product thinking with cutting-edge visual design.

Pricing Model: Project-based with minimum 4-week discovery and design phases

Web3-Focused Fintech Portfolio:

MYSO Finance , Decentralized finance lending protocol with wallet integration

Sage Express , Cross-border financial infrastructure ($700 million in funding secured)

Klasha , Cross-border commerce and payment solutions for African markets

Shardeum , Blockchain platform UX focused on trust-building and transaction transparency

Deloitte's 2024 Blockchain Report notes that 67% of users abandon Web3 financial applications due to complexity and unfamiliar interaction paradigms. Arounda specializes in bridging this gap, translating decentralized architecture into familiar financial mental models.

9. Artkai

The Engineering-Led Design Partner

Artkai distinguishes itself by merging substantial technical engineering capability with sophisticated design execution. This integration proves essential for fintech products requiring complex backend operations, blockchain consensus mechanisms, core banking systems, real-time payment rails, to function seamlessly with frontend interfaces. Their mid-to-premium pricing offers competitive value compared to US-based agencies.

Pricing Model: Project-based in mid-to-premium range

Technically Complex Fintech Portfolio:

Huobi Global , Major cryptocurrency exchange with high-frequency trading interfaces

Coinloan , Crypto-backed lending platform managing collateral visualization

Procredit , Banking group digital transformation across multiple markets

HedgeFlows , Financial risk management dashboards for small and medium enterprises

Research from the Journal of Financial Technology indicates that 58% of fintech failures stem from disconnect between frontend design and backend capabilities. Artkai's engineering-first methodology prevents the technical debt accumulation that often undermines beautifully designed but functionally limited interfaces.

10. Qubika

The AI & Core Banking Expert

Qubika concentrates on infrastructure design rather than marketing-facing interfaces. Their expertise encompasses secure, AI-driven financial platforms, fraud prevention systems, and core banking architecture, enterprise-scale engagements requiring deep understanding of financial regulations, security protocols, and institutional requirements.

Pricing Model: Enterprise-tier with custom engagement structures

Infrastructure-Focused Fintech Portfolio:

OnePay , Walmart's comprehensive digital banking and payment solution serving millions of transactions daily

Avant , Credit and lending platform for near-prime borrowers with sophisticated underwriting interfaces

Fraud Prevention Tools , Internal security platforms deployed at major financial institutions utilizing machine learning pattern detection

According to PwC's Global Fintech Survey, financial institutions allocate 31% of their technology budgets to fraud prevention and security, making specialized agencies like Qubika essential partners for platforms where user trust depends entirely on transactional integrity.

The agencies profiled above represent diverse approaches to financial product design, from boutique specialists to enterprise-scale partners. The common thread: deep understanding of how users interact with money, obsessive attention to security and trust signals, and the technical sophistication required to transform regulatory complexity into elegant user experiences. In an industry where Forrester estimates every dollar invested in UX returns $100 in value, selecting the right design partner isn't a cosmetic decision, it's a fundamental business strategy.