Last Update:

Feb 10, 2026

Share

Engagement Fundamentals:

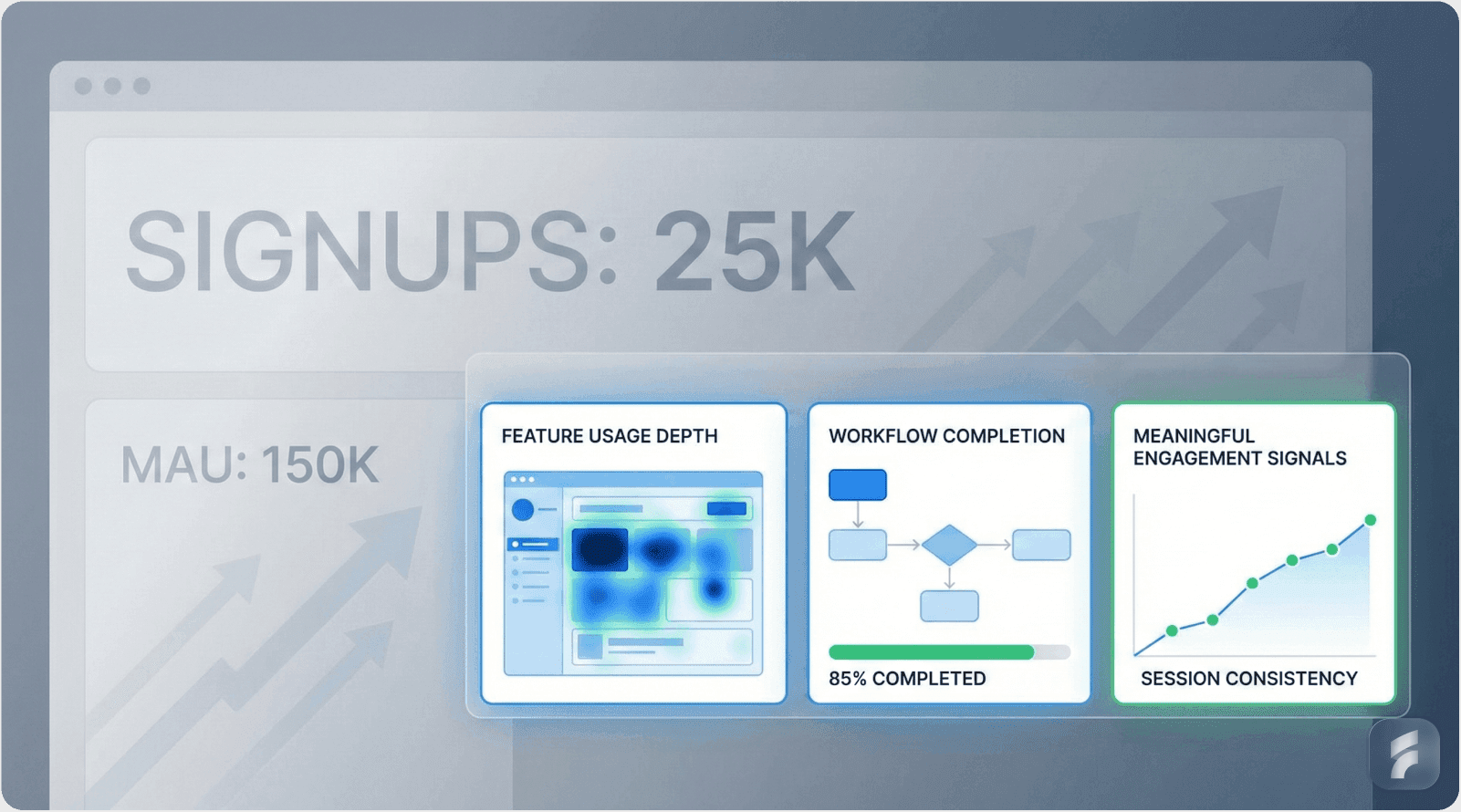

Product engagement tracks user interaction through metrics like logins, feature usage, and time spent—not vanity metrics like signups.

Engaged users are significantly more likely to pay continuously and generate more expansion revenue

Early-Stage Focus Areas:

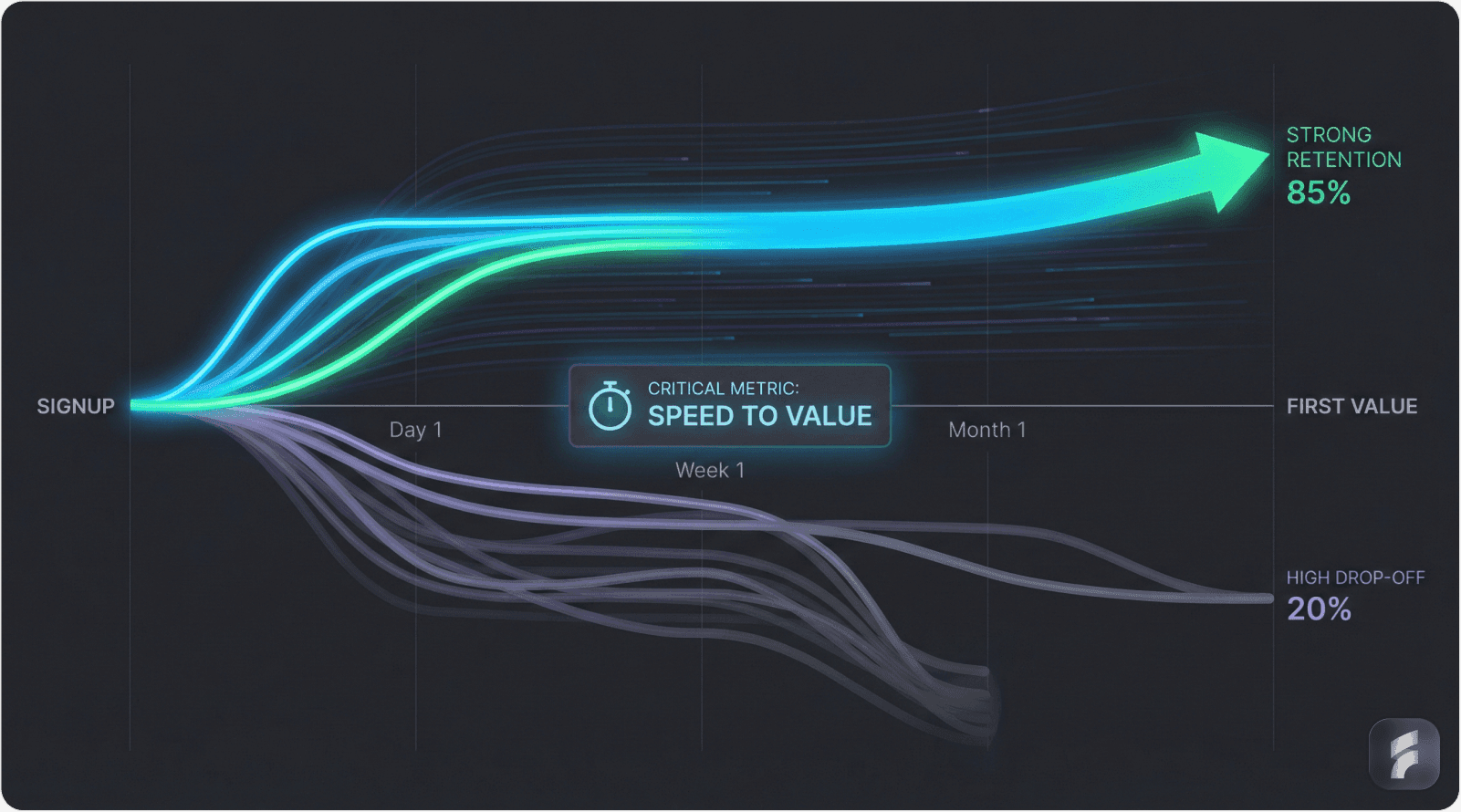

Focus on reducing Time to First Value (TTFV) by 50%, which can improve 90-day retention by 30%.

Prioritize meaningful metrics like activation rate and feature adoption over basic engagement metrics.

Use tools like Mixpanel, Amplitude, and Heap for early-stage analytics.

Growth-Stage Priorities:

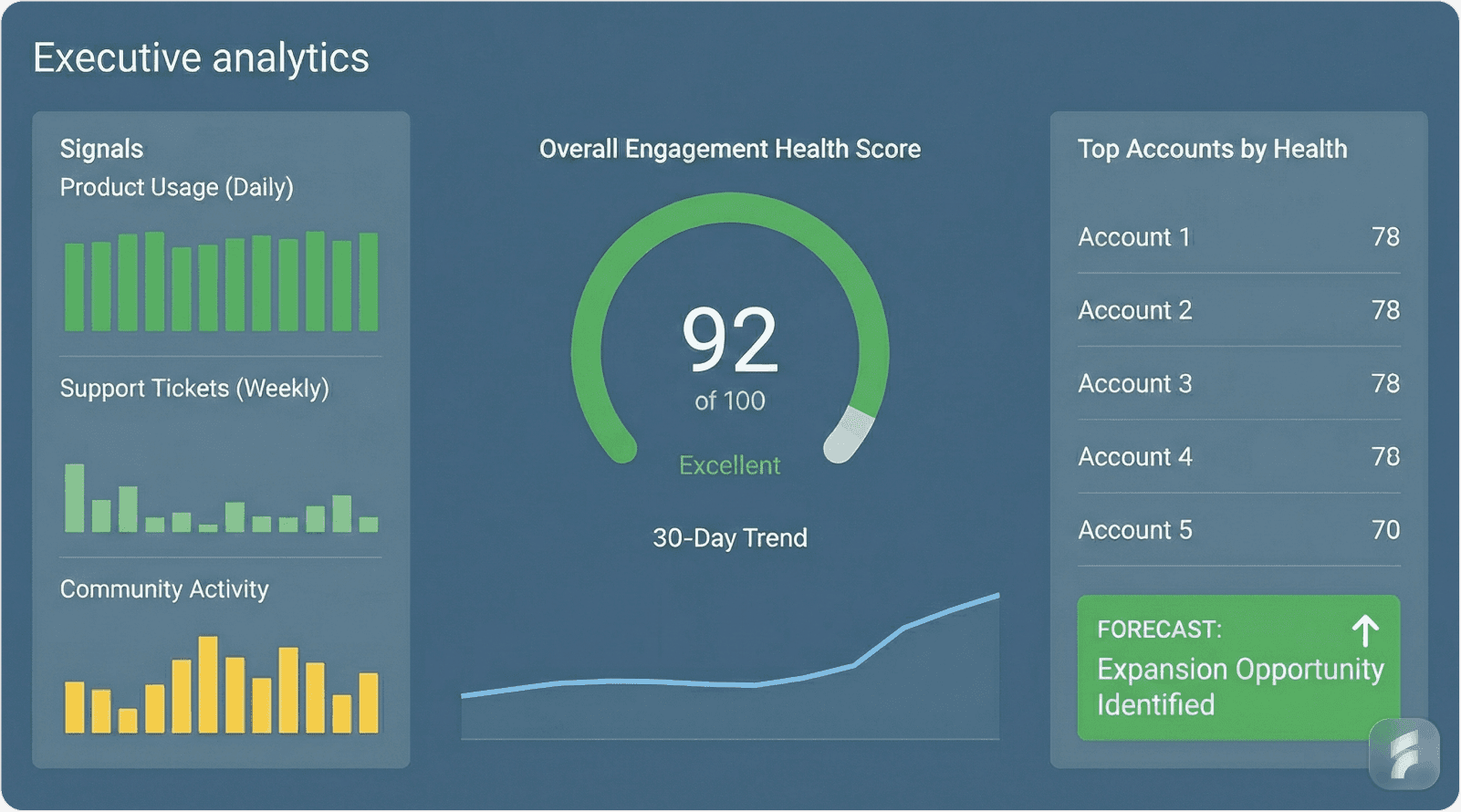

Shift to tracking Customer Lifetime Value (LTV), Net Revenue Retention (NRR), and engagement health scores.

Companies with better engagement tracking see significantly higher NRR.

Implement tools like Segment, Looker, and Tableau for advanced analytics.

Critical Success Metrics:

For high-performing SaaS, an activation rate of 40-60% within the first week is ideal.

Aim for an LTV/CAC ratio of 3:1 or higher for sustainable economics.

Achieve 30-50% retention by Week 4 to indicate product-market fit.

Behavioral Insights and Tools:

Early-stage companies should focus on tools like Google Analytics 4 and Mixpanel to track core metrics.

Growth-stage companies should use more advanced platforms like Gainsight and Pendo for deeper insights into user behavior and engagement.

Avoiding Pitfalls:

Avoid over-relying on vanity metrics (e.g., MAU, signups) and instead focus on actionable metrics.

Use segmentation to tailor strategies and don’t treat all users the same.

Actionable Principles:

Define clear business outcomes before selecting metrics.

Track actionable metrics—metrics that directly impact decisions and outcomes.

Case Studies:

Slack: Shifted focus from individual metrics to team-based engagement, leading to better retention.

Dropbox: Used behavioral segmentation to identify power users and optimize engagement, reducing churn by 23%.

Introduction: The Power of Product Engagement

In the competitive Software-as-a-Service landscape, engagement metrics represent far more than vanity numbers. They form the foundation of sustainable growth and revenue expansion. According to recent research from Bain & Company, a 5% increase in customer retention can boost profits by 25% to 95%. This statistic underscores why engagement analytics have become mission-critical for SaaS companies at every stage of maturity.

Understanding the Engagement Imperative

Product engagement measures the depth and frequency of user interactions with your platform. These interactions include feature activation, session duration, workflow completion rates, and behavioral sequences that indicate value realization.

For early-stage SaaS startups, engagement insights validate product-market fit (PMF) and guide iteration priorities. For growth-stage companies, sustained engagement drives long-term retention, expansion revenue, and customer lifetime value (LTV).

As Sean Ellis, founder of GrowthHackers, notes: "The companies that win are those that understand not just who their users are, but how deeply those users engage with the core value proposition."

The Data-Driven Engagement Framework

Analytics transform subjective assumptions into objective insights. They reveal behavioral patterns that guide strategic decisions across product development, customer success, and revenue optimization.

This comprehensive guide explores analytics implementation across two critical phases:

Early-Stage SaaS: Optimizing user experience and accelerating initial product adoption through engagement signals

Growth-Stage SaaS: Sustaining retention, measuring longitudinal engagement, and scaling customer base expansion

Understanding how to align your product design with engagement metrics is essential for building products that users love and continue using.

Micro-Summary: Engagement analytics provide the empirical foundation for SaaS success. Understanding how to measure, interpret, and act on engagement data separates thriving companies from those that struggle with retention and growth.

The Importance of Analytics for SaaS Engagement

Defining Product Engagement

Product engagement encompasses the qualitative and quantitative measures of user interaction depth. According to the Product-Led Growth Collective, engagement extends beyond simple usage metrics to include cognitive investment, emotional connection, and habitual behavior formation.

Definition Block:

Product Engagement = (Feature Adoption Rate × Usage Frequency × Session Duration) ÷ Activation Friction

Key engagement indicators include:

Login frequency and session consistency

Feature adoption breadth and depth

Time to value (TTV) achievement

Workflow completion rates

Cross-functional feature usage

Collaboration intensity metrics

The Engagement Gap Challenge

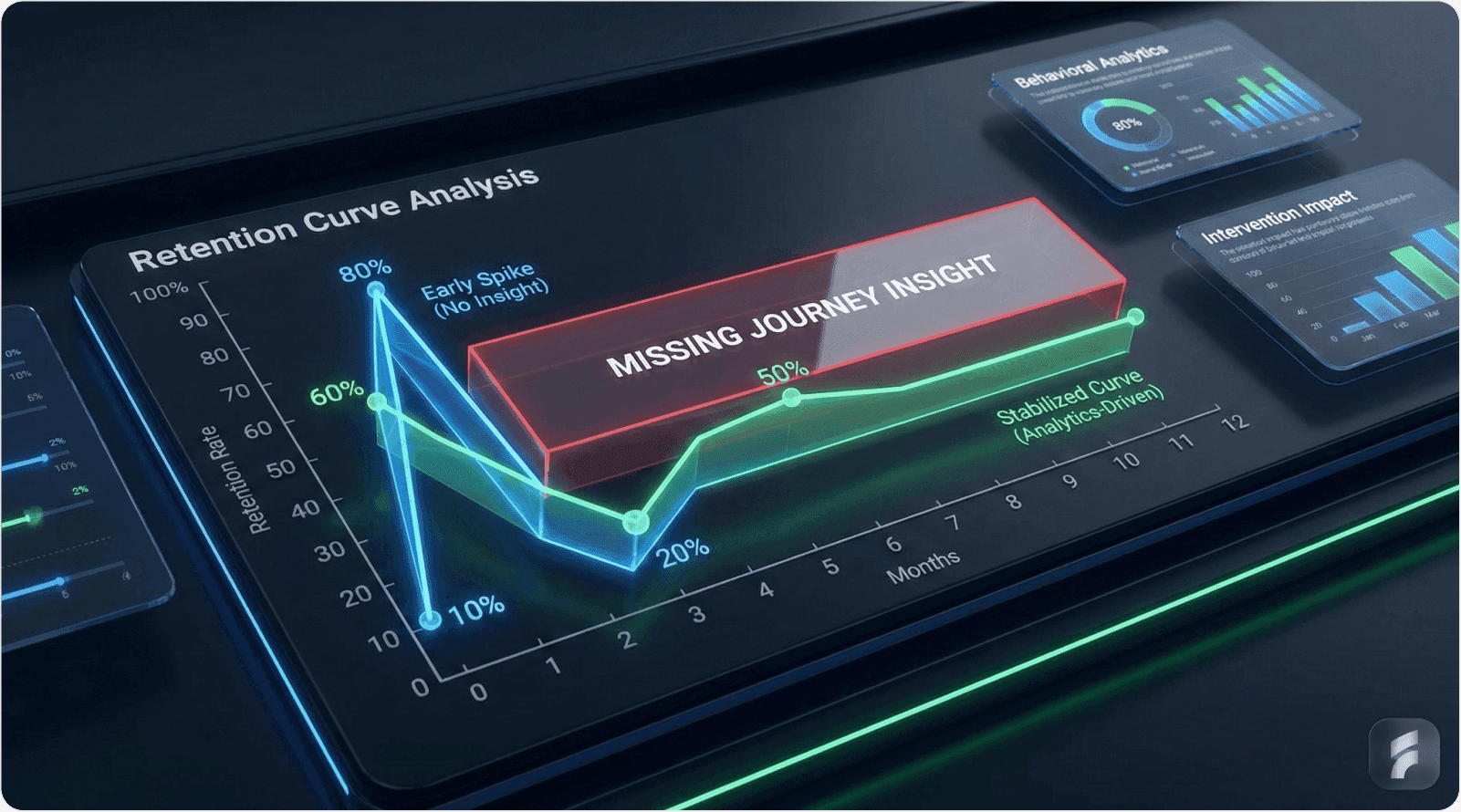

Research from Gartner reveals that 80% of businesses fail to convert initial user engagement into sustained retention. This engagement decay stems primarily from inadequate understanding of the user journey and misalignment between product capabilities and user mental models.

The Stanford Digital Economy Lab found that companies investing in behavioral analytics infrastructure see 3.2x higher retention rates compared to those relying on basic usage metrics alone.

Conducting a thorough UX audit can help identify these engagement gaps and reveal opportunities for improvement in your user journey.

Why Track Engagement?

Customer Retention and Revenue Stability

Engaged users demonstrate significantly higher retention propensity. HubSpot's 2024 SaaS Benchmark Report shows that highly engaged customers exhibit 3x greater retention likelihood than minimally engaged users.

As Lincoln Murphy, customer success strategist, observes: "Retention isn't about preventing cancellations. It's about continuously delivering value that makes cancellation unthinkable."

The retention-revenue correlation is substantial. Companies tracking engagement health scores report 67% lower churn rates according to Totango's Customer Success Benchmark Study.

Revenue Growth and Expansion Opportunities

Engagement analytics unlock upsell and cross-sell pathways. Pendo's Product Benchmarks Report indicates that companies with sophisticated engagement tracking achieve 2.1x more expansion revenue than those monitoring only basic metrics.

The correlation between engagement depth and revenue expansion is direct. Users who adopt three or more features generate 4x the lifetime value of single-feature users, according to Gainsight research.

Product Development Prioritization

Engagement data provides empirical validation for product roadmap decisions. The Nielsen Norman Group emphasizes that feature usage analytics reduce development waste by identifying high-impact improvements versus low-value additions.

According to MIT Sloan Management Review, data-driven product teams ship features with 40% higher adoption rates by leveraging engagement analytics during the design phase.

Micro-Summary: Analytics-driven engagement tracking delivers three critical benefits: improved customer retention through behavioral insights, expanded revenue via targeted upsell opportunities, and optimized product development through evidence-based prioritization.

Challenges in Product Engagement Tracking

Early-Stage SaaS: Getting the Data Right

Early-stage companies face unique analytical challenges. Limited user bases create statistical noise. Resource constraints restrict analytics infrastructure sophistication. Product iteration velocity complicates metric consistency.

The Vanity Metrics Trap

Many startups fixate on superficial indicators like monthly active users (MAU) or registration counts without examining behavioral quality. These metrics inflate perceived success while masking engagement deficiencies.

Problem Definition: Surface-level activity tracking without meaningful interaction depth analysis leads to misaligned optimization efforts and missed retention opportunities.

The Solution: Deep Engagement Signals

Effective early-stage analytics focus on activation quality over quantity. According to the Reforge Product Strategy Program, successful startups prioritize:

Time to First Value (TTFV): Duration between signup and initial value realization

Activation Rate: Percentage of users completing core workflow

Feature Adoption Depth: Number of distinct features used within first 30 days

Engagement Momentum: Week-over-week usage growth patterns

Research from OpenView Partners shows that reducing TTFV by 50% correlates with 30% higher 90-day retention rates.

Implementing UX optimization strategies can significantly reduce friction and accelerate time to first value for your users.

Real-World Case Study: Slack's Early Engagement Evolution

Slack faced initial challenges measuring meaningful engagement. Simple signup metrics provided insufficient insight into team adoption dynamics and collaborative value delivery.

Their analytics transformation focused on team-level engagement depth. Key metrics included:

Messages exchanged per team per day

Channel creation and participation rates

Integration activation frequency

Cross-team communication patterns

According to Stewart Butterfield, Slack's co-founder: "We realized that individual usage was meaningless. Team engagement was everything."

By shifting from individual to collective engagement metrics, Slack identified that teams sending 2,000+ messages demonstrated 93% retention likelihood. This insight drove targeted onboarding optimization and retention strategies.

The results were substantial. Slack's focus on engagement depth contributed to achieving 8 million daily active users within three years of launch, with best-in-class retention metrics.

Market Statistics and Industry Benchmarks

Current SaaS engagement tracking reveals significant trends:

48% of SaaS companies prioritize feature adoption and engagement depth as their primary analytics focus (Totango 2023 SaaS Benchmark Report)

73% of SaaS leaders report that user engagement data directly informs customer retention strategies (Forrester Research)

Companies tracking engagement health scores experience 2.5x faster time-to-value for new users (ChurnZero Analytics Study)

62% of early-stage SaaS companies struggle with distinguishing signal from noise in engagement data (SaaS Capital Index)

Essential Tools for Early-Stage SaaS

Google Analytics 4

Event-based tracking architecture for custom interaction monitoring

User journey visualization across touchpoints

Integration with product analytics platforms

Best for: Basic behavioral tracking and funnel analysis

Mixpanel

Advanced event tracking with property-level granularity

Cohort analysis for retention pattern identification

Time-to-event metrics for activation monitoring

Best for: Feature adoption tracking and user segmentation

Amplitude

Behavioral cohorts with predictive analytics capabilities

Retention curve analysis across user segments

Funnel optimization with conversion driver identification

Best for: Product-market fit validation and iteration guidance

Heap

Automatic event capture eliminating manual instrumentation

Retroactive analysis of historical user behavior

Session replay for qualitative understanding

Best for: Resource-constrained teams needing comprehensive tracking

Micro-Summary: Early-stage companies must transcend vanity metrics and implement behavioral analytics that reveal activation quality, feature adoption patterns, and engagement momentum. The right tooling combined with focused metric selection enables data-driven product iteration even with limited resources.

Growth-Stage SaaS: Refining Engagement and Expanding User Value

The Engagement Maturity Transition

Growth-stage companies operate with validated product-market fit and established customer bases. The analytical focus shifts from survival to optimization, from activation to expansion, and from basic tracking to sophisticated behavioral prediction.

According to Boston Consulting Group, companies transitioning from early to growth stage that maintain analytical rigor achieve 2.8x faster revenue growth than those that plateau on basic metrics.

The Sophistication Gap Challenge

Many growth-stage teams continue using early-stage analytics frameworks despite fundamentally different business requirements. This creates blind spots around expansion opportunities, churn predictors, and segment-specific engagement patterns.

Problem Definition: Teams struggle to evolve from basic engagement metrics to strategic insights that drive expansion revenue, reduce churn, and optimize customer lifetime value across diverse user segments.

The Solution: Advanced Engagement Architecture

Growth-stage analytics require multidimensional frameworks. As Julie Zhuo, former VP of Product Design at Facebook, states: "At scale, you're not optimizing for the average user. You're optimizing for the right behavioral patterns across distinct cohorts."

Key growth-stage metrics include:

Customer Lifetime Value (LTV): Predicted revenue per customer accounting for expansion and retention probability

Retention Cohorts: Time-series analysis of engagement persistence across acquisition periods

Feature Expansion Rate: Progression from initial to advanced capability adoption

Conversion Velocity: Time and touchpoints required for upgrade decisions

Engagement Health Score: Composite metric predicting churn risk and expansion readiness

Research from Pacific Crest Securities shows that SaaS companies tracking LTV/CAC ratios above 3:1 with detailed cohort analysis achieve 40% higher valuations than metrics-poor competitors.

For SaaS companies looking to scale their analytics capabilities, partnering with experienced product design teams can accelerate the implementation of sophisticated engagement frameworks.

Real-World Case Study: Dropbox's Retention and Expansion Strategy

Dropbox exemplifies growth-stage analytics sophistication. Moving beyond simple storage metrics, they implemented behavioral segmentation to identify high-value user patterns and expansion opportunities.

Their analytics transformation included:

Behavioral Segmentation

Power users identified through sharing frequency and collaboration depth

Viral coefficient tracking across referral patterns

Feature adoption sequences predicting upgrade likelihood

Usage intensity correlation with retention probability

Targeted Engagement Interventions

Personalized feature discovery based on usage patterns

Referral incentives aligned with viral user behaviors

Upgrade prompts timed to expansion readiness signals

Retention campaigns targeting at-risk user segments

Drew Houston, Dropbox CEO, emphasized: "Understanding not just what users do, but why they do it and what they might do next—that's where the value lies."

The results demonstrated analytics' strategic impact. Dropbox reduced annual churn by 23% while increasing expansion revenue by 35% through targeted engagement optimization.

Market Statistics and Growth Benchmarks

Current growth-stage engagement trends reveal:

77% of SaaS companies identify retention improvement as their top growth-stage analytics priority (ProfitWell SaaS Metrics Report)

36% of SaaS businesses achieved 20%+ revenue growth by leveraging engagement analytics for onboarding and retention optimization (McKinsey Digital)

Companies with sophisticated engagement health scoring reduce churn by 31% on average (Gainsight Customer Success Index)

Growth-stage companies tracking expansion engagement see 2.4x higher net revenue retention (NRR) than those monitoring only core usage (KeyBanc Capital Markets)

58% of SaaS executives cite engagement analytics as critical for achieving Rule of 40 benchmarks (SaaS Capital)

Essential Tools for Growth-Stage SaaS

Segment

Customer data platform consolidating cross-tool analytics

Identity resolution across devices and touchpoints

Real-time audience segmentation for personalization

Best for: Unified behavioral tracking across complex user journeys

Tableau

Advanced data visualization for executive-level insights

LTV modeling with cohort performance analysis

Expansion revenue attribution tracking

Best for: Strategic analytics and board-level reporting

Looker

SQL-based exploration for custom metric creation

Feature usage correlation analysis

Conversion trend identification across segments

Best for: Data-driven product and growth teams

Pendo

In-app analytics combined with user feedback collection

Feature adoption tracking with NPS correlation

Product analytics roadmap alignment

Best for: Product-led growth organizations

Gainsight

Customer health scoring with churn prediction

Engagement trending across customer lifecycle stages

Success plan alignment with usage patterns

Best for: Customer success-driven retention strategies

Micro-Summary: Growth-stage companies require sophisticated analytics architectures that track LTV, retention cohorts, feature expansion patterns, and engagement health scores. Advanced tooling enables the segmentation, prediction, and personalization necessary for scaling sustainable revenue growth.

Framework for Effective Product Engagement Analytics

Building a Data-Driven Engagement Strategy

Effective engagement analytics align measurement with business objectives, regardless of company stage. The Lean Analytics framework emphasizes finding the "one metric that matters" while maintaining visibility into supporting indicators.

According to Harvard Business Review, companies with clearly defined engagement frameworks achieve KPIs 3.5x faster than those with ad-hoc measurement approaches.

Step 1: Set Clear Engagement Goals

Objective Definition

Success requires concrete, measurable engagement targets aligned with business outcomes. Vague aspirations like "improve engagement" lack the specificity needed for analytical focus and optimization prioritization.

Goal Framework:

Specific: Define exact metrics and target values

Measurable: Ensure quantitative tracking capability

Achievable: Set realistic targets based on baseline performance

Relevant: Align with revenue and retention objectives

Time-bound: Establish clear deadline constraints

Example Goal Structures:

Early-Stage: Increase 7-day activation rate from 35% to 50% within 90 days by optimizing onboarding workflow and reducing time-to-first-value

Growth-Stage: Improve 12-month retention from 78% to 85% in the next two quarters by increasing feature adoption breadth among single-feature users

Research from the Product-Led Alliance shows that companies with quantified engagement goals achieve them 67% more frequently than those with qualitative aspirations.

Step 2: Measure Early Indicators of Engagement

Activation Metrics That Predict Retention

Early engagement signals provide predictive power for long-term user behavior. According to research from Reforge, users achieving core value within their first session demonstrate 4x higher 90-day retention.

Critical Early Indicators:

Time to First Value (TTFV): Duration from signup to initial value realization

Industry benchmark: Under 5 minutes for horizontal SaaS, under 15 minutes for vertical SaaS (OpenView Partners)

Activation Rate: Percentage completing essential workflow setup

High-performing SaaS: 40-60% activation within first week (Mixpanel Benchmarks)

Feature Adoption Velocity: Speed of secondary feature discovery

Engaged users adopt second feature within 72 hours (Amplitude Product Intelligence)

Engagement Frequency: Return visit consistency within first 30 days

3+ sessions weekly correlates with 80%+ retention (Pendo Product Benchmarks)

Real-World Application: Trello's Activation Focus

Trello identified that users creating their first board and inviting a collaborator within 24 hours achieved 75% higher long-term retention. This insight drove onboarding optimization prioritizing collaborative activation over individual task management.

Michael Pryor, Trello co-founder, explains: "We learned that collaboration, not organization, was the real activation moment. That shifted everything about our onboarding."

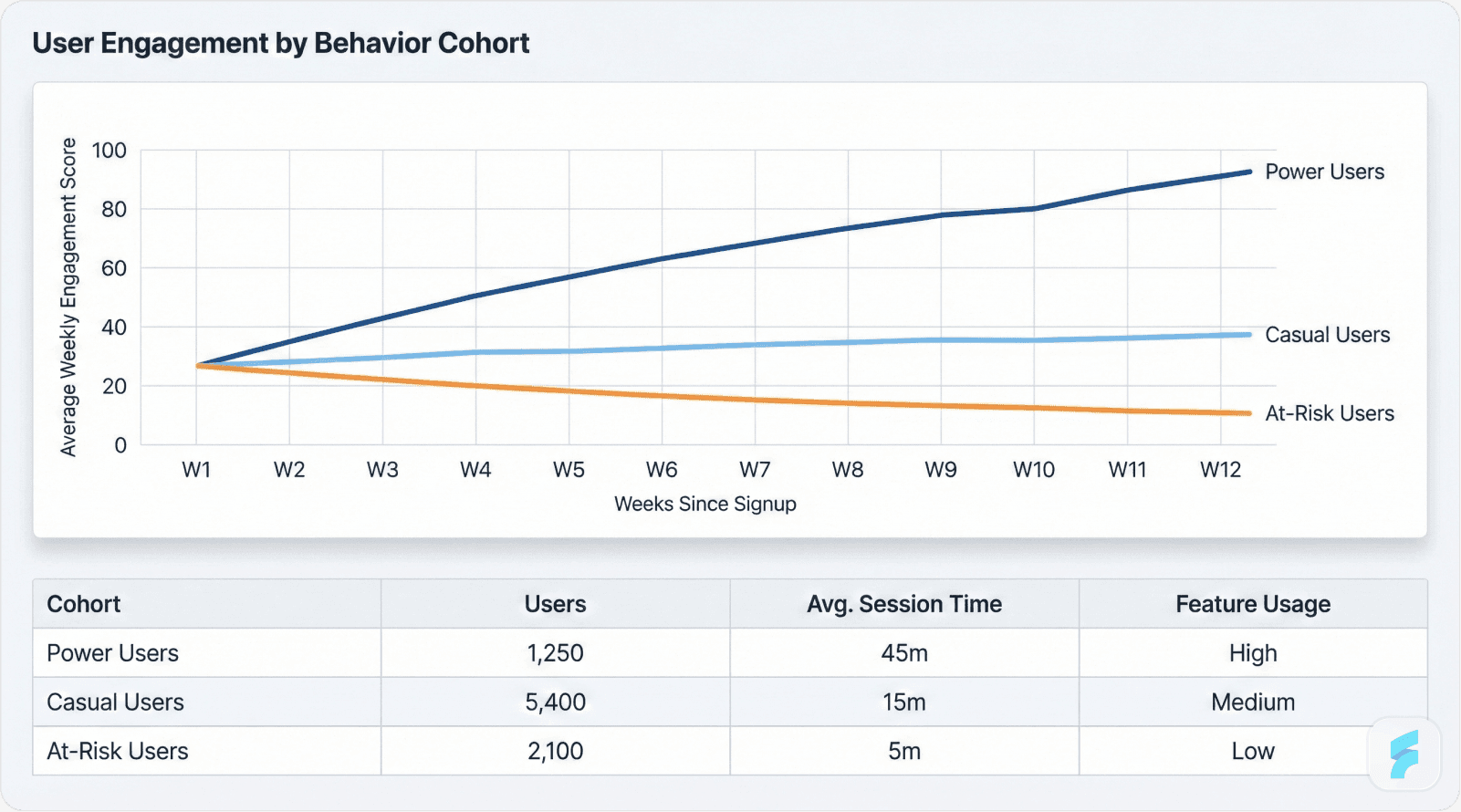

Step 3: Focus on User Segmentation and Cohorts

Behavioral Clustering for Targeted Optimization

User segmentation reveals distinct engagement patterns invisible in aggregate metrics. According to McKinsey, companies implementing behavioral segmentation achieve 10-20% revenue growth through targeted experience optimization.

Segmentation Dimensions:

Behavioral Cohorts: Groups defined by action patterns (power users, casual users, at-risk users)

Acquisition Cohorts: Users grouped by signup period for retention trending

Feature Cohorts: Segments based on capability adoption patterns

Value Cohorts: Groups stratified by revenue contribution or expansion potential

Cohort Analysis Framework

Cohort retention analysis reveals how engagement patterns evolve over time. According to Lenny Rachitsky's research on retention curves, products with strong product-market fit demonstrate flattening retention curves after initial drop-off.

Week 1 Retention: 40-60% for healthy SaaS products

Week 4 Retention: 30-50% retention floor indicates PMF

Week 12+ Retention: Curve flattening signals sustainable engagement

Real-World Application: Notion's Template Engagement Strategy

Notion's analytics revealed that users engaging with templates during their first month demonstrated 2.3x higher retention rates. This insight drove template discoverability optimization and personalized template recommendations.

Ivan Zhao, Notion CEO, notes: "Templates weren't just features—they were engagement catalysts that transformed how users experienced the product's potential."

By creating behavioral segments around template usage, Notion developed targeted retention campaigns and onboarding variations that significantly improved long-term engagement metrics.

Explore how Saasfactor helps companies implement data-driven design strategies that improve user engagement and retention.

Step 4: Leverage Retention Metrics

Longitudinal Engagement Analysis

Retention metrics provide the clearest signal of product value delivery. According to Andreessen Horowitz, retention is the single best predictor of product-market fit and sustainable growth potential.

Key Retention Frameworks:

Cohort Retention: Time-series tracking of engagement persistence across acquisition groups

Best practice: Weekly cohort analysis for SaaS products (Lenny's Newsletter)

Feature-Specific Retention: Adoption persistence for individual capabilities

High-value features: 60%+ 30-day retention (Mixpanel)

Resurrection Metrics: Re-engagement rates for churned or dormant users

Industry average: 15-25% resurrection within 90 days (ProfitWell)

Formula Block:

Net Retention Rate = [(Customers at Period End - New Customers) / Customers at Period Start] × 100

Real-World Application: Shopify's Advanced Feature Adoption

Shopify's analytics identified that merchants adopting Shopify Payments within their first 60 days demonstrated 45% lower churn and 3x higher GMV growth compared to third-party payment users.

This insight drove personalized onboarding sequences emphasizing Payments adoption. The team implemented behavioral triggers prompting Payments setup when merchants reached specific GMV thresholds, optimizing timing for maximum conversion likelihood.

Tobi Lütke, Shopify CEO, emphasized: "Every feature adoption decision is an engagement decision. We optimize for the adoption moments that predict long-term merchant success."

The results included 27% increase in Payments adoption and measurable improvement in merchant retention and expansion revenue.

Step 5: Use A/B Testing for Feature Engagement

Experimental Optimization of Engagement Drivers

Controlled experimentation eliminates subjective decision-making from engagement optimization. According to the Harvard Business Review, companies with strong experimentation cultures achieve 30% higher profit margins through systematic optimization.

A/B Testing Framework for Engagement:

Onboarding Flow Variations: Test sequence, length, and content density

Shopify found 3-step onboarding outperformed 7-step by 23% (First Round Review)

Feature Placement Testing: Optimize discoverability and interaction cost

50ms reduction in interaction latency improves conversion by 1-2% (Google Research)

Messaging and Copy Variations: Test value proposition clarity and calls-to-action

Personalized messaging increases engagement 20-40% (Optimizely Benchmarks)

Timing and Trigger Testing: Optimize when engagement prompts appear

Contextual triggers outperform time-based by 3x (Intercom Product Research)

Real-World Application: Slack's Onboarding Experimentation

Slack conducted extensive A/B testing on onboarding flows, testing variations including:

Channel creation prompts at different user journey stages

Team invitation timing and messaging

Feature discovery tour length and interactivity

Bot-guided versus self-directed setup experiences

Critical finding: Users engaging with team communication channels within their first session demonstrated 3.1x higher Week 4 retention compared to users completing other onboarding activities first.

Stewart Butterfield explains: "We learned that getting people into conversations, not showing them features, was the activation unlock. Testing proved what intuition couldn't."

This data-driven insight fundamentally reshaped Slack's onboarding strategy, prioritizing social engagement over feature education—a decision contributing to their exceptional retention metrics.

Micro-Summary: Effective engagement analytics require clear goals, early indicator tracking, behavioral segmentation, retention analysis, and experimental optimization. This five-step framework enables systematic improvement regardless of company stage, product type, or market vertical.

Conclusion

The Analytics-Driven Engagement Imperative

Product engagement represents the fundamental health metric for SaaS businesses. In an increasingly competitive landscape where switching costs continue declining and user expectations continuously rising, sustained engagement determines survival and success.

Analytics transform engagement from aspirational concept to operational reality. They provide the empirical foundation for product decisions, growth strategies, and resource allocation across the customer lifecycle.

From Measurement to Action

The true value of engagement analytics emerges not from data collection but from insight application. According to Bain & Company, companies translating analytics insights into systematic action achieve 5-6% higher profitability than analytics-rich but action-poor competitors.

Effective engagement optimization requires:

Measurement Discipline: Consistent tracking of validated engagement indicators

Analytical Rigor: Proper statistical interpretation avoiding correlation-causation errors

Strategic Alignment: Clear connections between engagement metrics and business outcomes

Organizational Commitment: Cross-functional adoption of data-driven decision-making

Iterative Improvement: Continuous refinement of measurement and optimization approaches

The Sustainable Growth Equation

By implementing the frameworks, tools, and strategies outlined in this guide, SaaS companies position themselves for sustainable growth. The equation is straightforward:

Formula Block:

Sustainable SaaS Growth = (Product Value × Engagement Depth × Retention Excellence) ÷ Acquisition Cost

Each component depends on analytics for optimization. Product value requires usage data to identify high-impact features. Engagement depth demands behavioral tracking to reveal interaction patterns. Retention excellence necessitates cohort analysis to predict and prevent churn.

As Tomasz Tunguz, venture capitalist at Theory Ventures, observes:

"The best SaaS companies don't just track engagement—they engineer it systematically using data as their primary design tool."

Looking Forward

The engagement analytics landscape continues evolving. Machine learning enables predictive modeling of churn risk and expansion opportunity. Product-led growth strategies increase dependency on granular behavioral insights. Customer expectations for personalization demand segmentation sophistication.

Companies investing in engagement analytics infrastructure today build competitive advantages that compound over time. The insights gained inform not just immediate optimizations but strategic positioning and long-term differentiation.

Whether you're an early-stage startup validating product-market fit or a growth-stage company scaling sustainable revenue, engagement analytics provide the compass guiding decision-making in an uncertain environment.

The path to SaaS success is paved with data. Those who measure engagement effectively, interpret signals accurately, and act decisively will thrive in an increasingly competitive landscape.

Discover how SaaS Factor's blog offers additional insights on product strategy, UX design, and growth optimization for SaaS companies at every stage.

Final Thought: Engagement is not a static achievement but a continuous commitment. The companies that win are those that treat engagement analytics not as a reporting exercise but as a strategic capability—systematically measuring, relentlessly optimizing, and constantly delivering value that makes users choose to stay, expand, and advocate.

References

Andreessen Horowitz - Product-market fit and retention frameworks

Atlassian - Cross-functional analytics and team performance research

Bain & Company - Customer retention and profitability research

Bessemer Venture Partners - Cloud software metrics and valuations

Boston Consulting Group - Growth-stage analytics and scaling strategies

ChurnZero - Engagement and churn prevention analytics

Forrester Research - Customer success and retention strategy insights

Gainsight - Customer health scoring and success metrics

Gartner - Enterprise SaaS engagement and adoption research

Google Research - User experience and performance impact studies

Harvard Business Review - Product management and engagement optimization

HubSpot - SaaS customer engagement benchmarks

KeyBanc Capital Markets - SaaS survey and performance metrics

Lean Analytics Framework - Startup metrics and measurement methodology

McKinsey Digital - Data-driven decision-making and analytics frameworks

MIT Sloan Management Review - Product development and analytics effectiveness

Mixpanel - Behavioral analytics benchmarks and best practices

Nielsen Norman Group - User experience and interaction cost research

OpenView Partners - SaaS benchmarks and expansion metrics

Optimizely - A/B testing and experimentation data

Pacific Crest Securities - SaaS Capital Efficiency research

Pendo - Product benchmarks and feature adoption data

Product-Led Growth Collective - PLG metrics and best practices

ProfitWell - Subscription analytics and retention research

Reforge - Product-led growth frameworks

SaaS Capital - Private SaaS company benchmarking

Stanford Digital Economy Lab - Behavioral analytics and retention studies

Totango - SaaS benchmark reports and engagement metrics

Y Combinator - Startup metrics and early-stage guidance